Amazon Ebooks Market Share 2019-2020

(This article was updated in March 2021 with recent data. Outdated links have been removed along with 2017 data from AuthorEarnings.com, now BookStat.)

Why sell Amazon ebooks? Because the Amazon market share is significant around the globe. When it comes to selling ebooks, Amazon KDP (Kindle Direct Publishing) is the place to be. Here's what to know.

Amazon Self-Publishing Isn’t the Only Way to Reach Readers

Brief overview: you can sell books on Amazon, a huge store making the most ecommerce sales in online shopping. The platform has Amazon prime, where prime members enjoy free two-day delivery. They not only get additional perks like the ebooks Kindle unlimited prime reading, but deals for bestsellers, more Kindle books, and etc. Customers enjoy Kindle countdown deals and more like used ebooks. We can understand why indies look at Amazon as the first place to go.

However, when looking at global ebook publishing, new stores and business models are emerging at a pretty fast pace. Read more about different business models in publishing.

We say do more with your ebook publishing business and make it profitable in the long run. Learn more about staying exclusive to Amazon vs. selling your books internationally.

You'd be losing potential readers and earnings by only selling to the Amazon ebook market. The Amazon market share is just a piece of this wide and lucrative pie.

This article starts with a deep analysis of our recent online sales numbers. Then we talk about the recent Author Earnings Report to understand ebook sales in the United States and emerging markets. We close with interesting facts about the Kindle app and Kindle reader market share.

PublishDrive writers increased digital book sales by 85%,

distributing to thousands of stores worldwide.

An Analysis of Amazon Ebook Sales Through PublishDrive

We explored what percentage of the book market Amazon captures, info about competitors, and more. This review comes from PublishDrive’s data collected in the past few years.

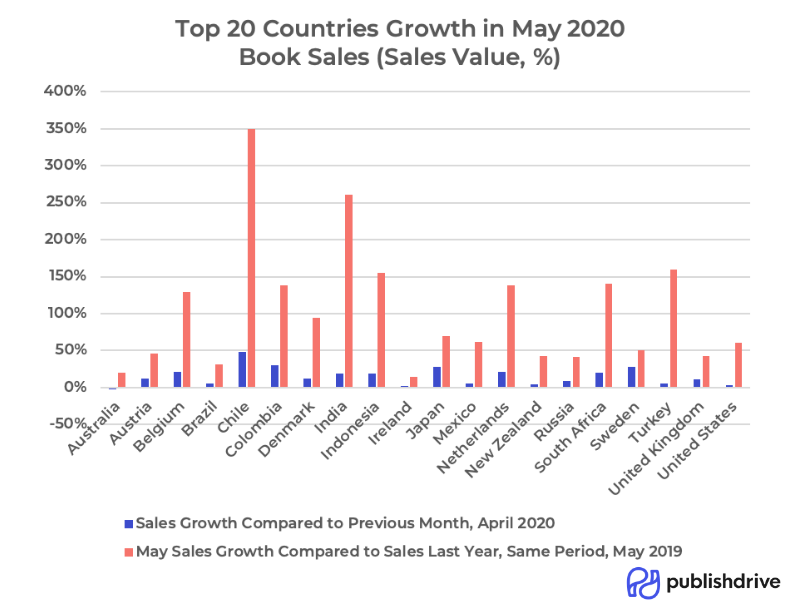

International Digital Book Sales in 2020

In March 2020 (despite the pandemic) PublishDrive saw growth by at least 20% across markets and stores. In April 2020, we reported another 23% growth.

When comparing the mid year of 2020 with 2019, book sales have increased by 60%. These growing sales numbers are super beneficial for PublishDrive indies who keep 100% royalties. Since we don’t take any commission, publishers get the same royalties as selling directly to stores. All this growth is 100% theirs.

Take a look the top growth rates by country:

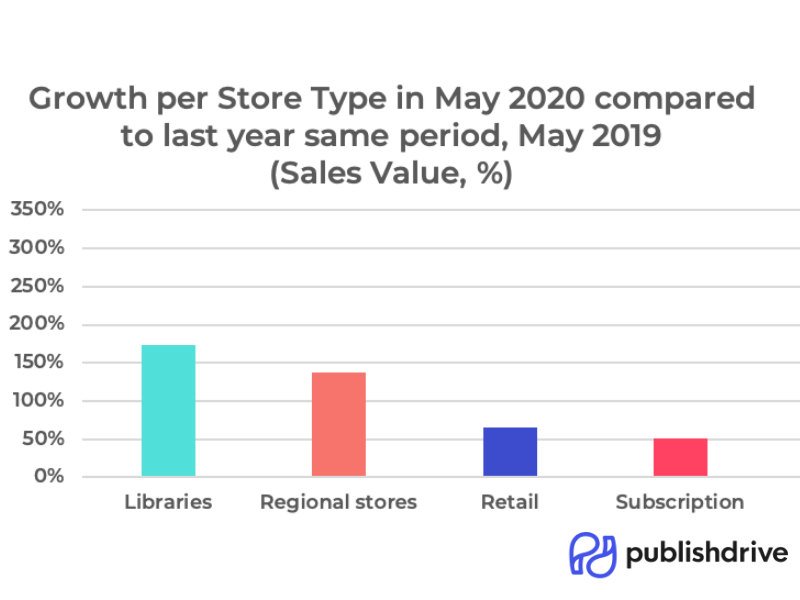

Also, device-related retailers are seeing spikes in sales. Book royalties come from different sources today, not just from selling one copy to a consumer. Typically, these sources can be categorized:

- Retail: Major outlets that reach global readers with the usual one copy purchase business model. E.g. Amazon, Apple Books, Barnes & Noble, Google Play Books, and Kobo.

- Subscription services: Usually applications or stores that provide unlimited access to books in exchange for a monthly subscription fee. E.g. Scribd, Bookmate, and Dreame.

- Digital library providers: Book borrowing for not just individuals, but institutions like public libraries, schools, universities, or corporate libraries. E.g. OverDrive, Bibliotheca, Mackin, and Odilo.

- Regional stores: Outlets that cover a specific region that serves the local community. E.g. Tolion, Chinese stores, Hungarian outlets, and German network.

Here are the benefits of publishing globally to more stores:

- Get the discoverability your content deserves, especially in Google searches. If you look at just Android devices, that's 2.5 billion potential readers you miss by selling exclusively on Amazon. Also, listing your content in multiple places enhances your Google search ranking.

- Access plenty of marketing perks with other stores. For example, you can send free review copies on Apple and Google (and exclusively on Amazon as a paid bump) with PublishDrive.

- There’s less risk by setting up more streams of income. It can help keep your business afloat especially during unpredictable times. Maximize your selling potential by selling on different channels. Take the risk and venture into audiobook or print-on-demand versions to add your business.

- With digital book sales on the rise almost everywhere, international markets want English-language content.

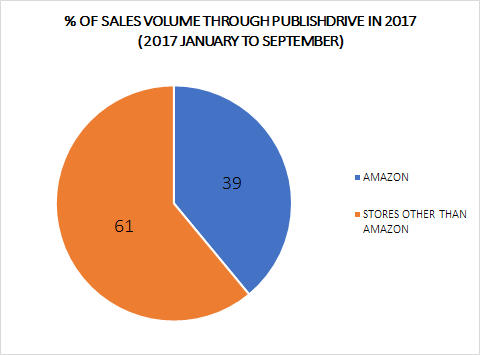

Amazon Ebook Market Share 2017

We looked at the sales numbers of publishers signed up to the platform. In the case of English titles, only 39% of the sales volume came from the Amazon ebook market.

If you sell ebooks on Amazon exclusively through KDP Select, you may lose 61% of your potential readers and sales.

Amazon only captured 39%: our users have sold many books with other channels integrated for English language books. PublishDrive has over 400 online stores and 120k digital libraries, including hard-to-reach markets like China.

But as you know, the self-publishing landscape changes every day; so let's take a look at what happened in 2018.

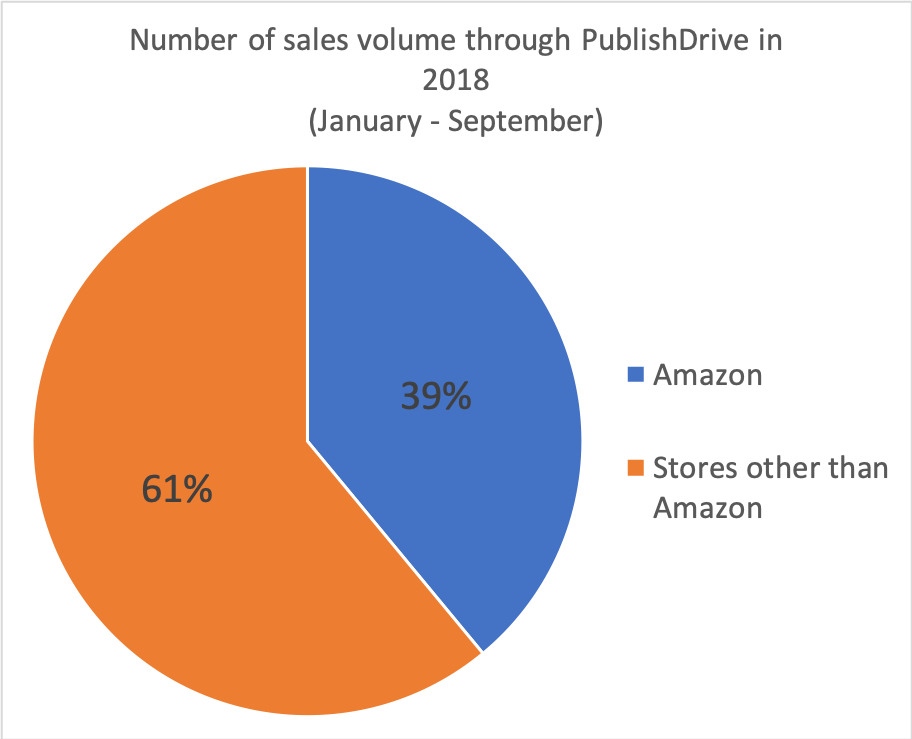

Amazon Ebook Market Share 2018

In 2018 we see that a large portion of the ebook market includes non-Amazon retailers, again! During 2018, we added DangDang to our distribution network that allowed indie authors to publish in the Chinese market.

These numbers include the library book market, not just traditional retail sales. Library distribution is another non-Amazon segment of the market that gives you boosted visibility and great royalty rates. In 2018, Bibliotheca joined PublishDrive’s growing list of library service providers.

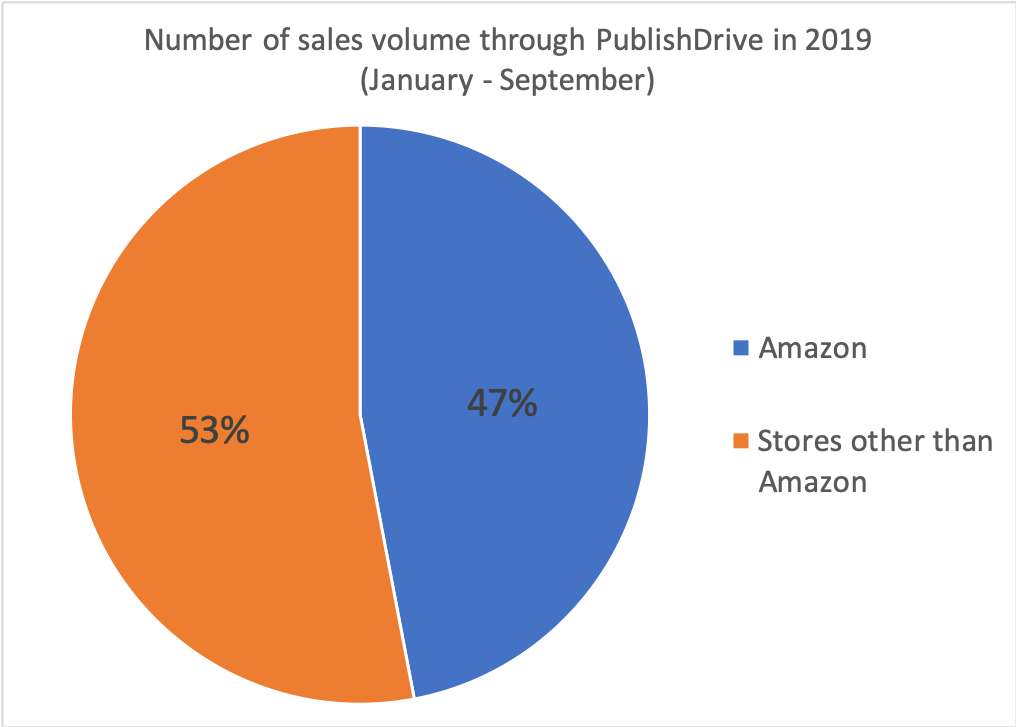

Amazon Ebook Market Share 2019

When looking at the ebook market share in 2019, we saw that the data shifted a bit.

Sales for Amazon ebooks through PublishDrive jumped by 8%, from 39% in 2018 and 47% in 2019. With 53% of sales happening in non-Amazon sales channels, it’s clear that Amazon shouldn’t be your only bet.

Every year, more opportunities appear for authors to increase their earnings. In 2019 we introduced the Dreame reading app where it uses a pay-per-episode model.

Kindle Unlimited/KDP Select isn’t the only reading subscription service that authors can choose from. It will be interesting to see how apps like Dreame will affect the ebook market going forward.

The US Ebook Market

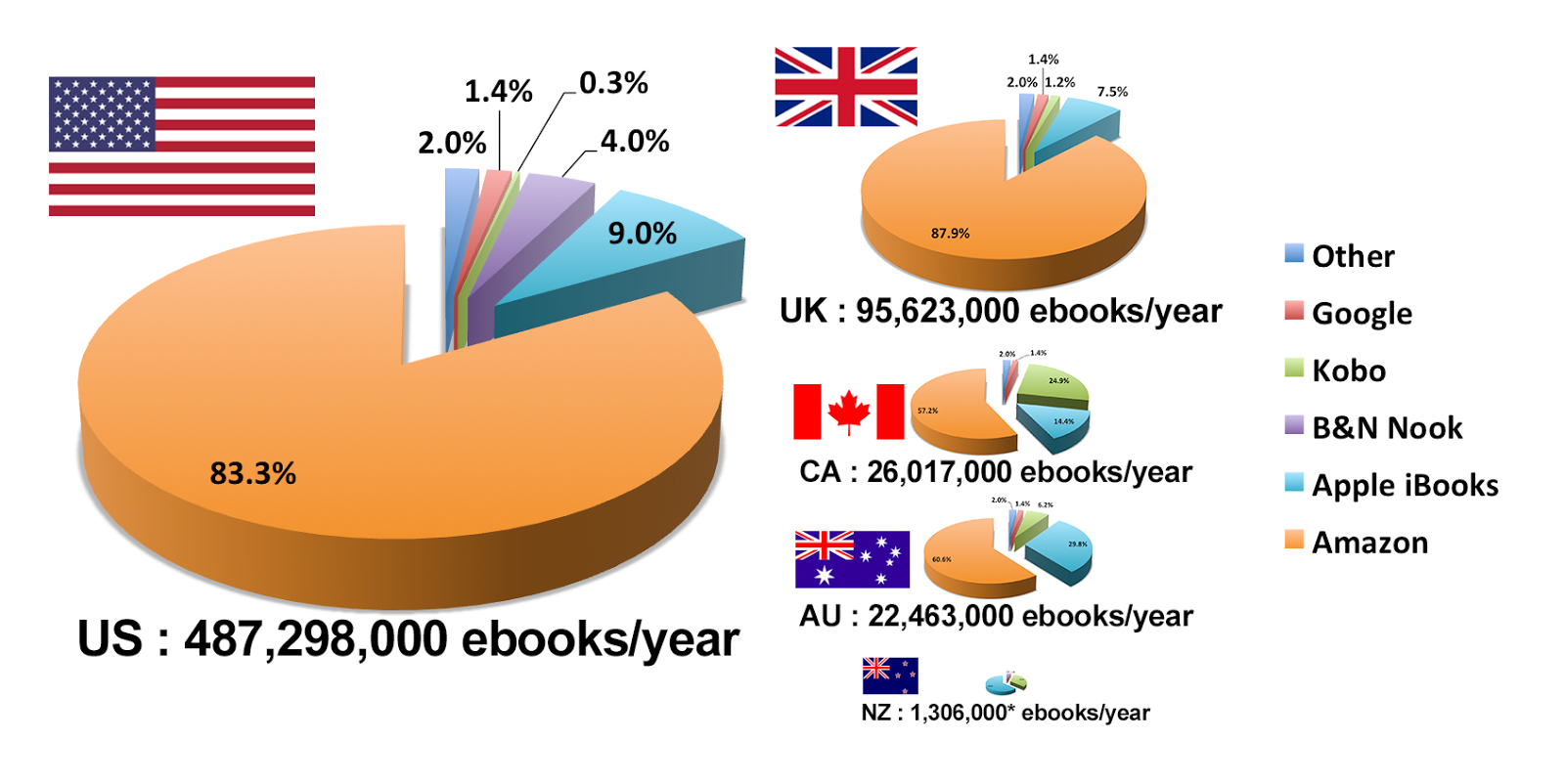

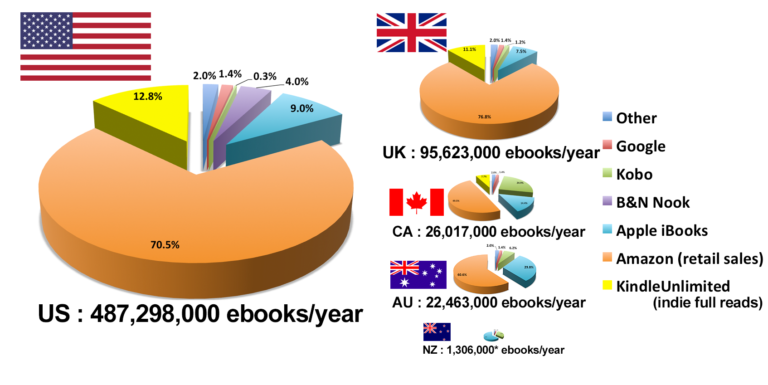

With indie books (published without ISBNs), the Amazon market share accounts for 83% of US ebook purchases. The rest is almost entirely shared between Apple Books, Barnes & Noble, Kobo, and Google Play Books.

In January 2016 there were around a million paid ebook downloads daily from the Amazon US store.

It’s pretty cool that while the share of traditional publishing houses fell, the indie market grew. Individual authors sell more ebooks daily on Amazon than publishers with ISBNs combined. This fall in ebook prices may be due to publishers keeping the prices high. Indie ebooks with single-author sales accounted for around 40% of total retail US ebook sales.

It’s interesting that last year, Kindle Unlimited was only responsible for 12% of independent authors’ income. In the US, this is similar to income from all non-Amazon sales channels. In other words, when you distribute books outside of the US and UK, the balance is tilted.

These numbers are not so surprising when we see that Amazon lets publishers set the prices. As a result, customers are drawn to lower prices provided by indie publishers.

There is little data available about indie sales outside of Amazon in the US. But we do know that many authors sell ebooks on Amazon exclusively for some titles and the rest at other places. They’re also changing platforms as often as every three months. As we mentioned in our article about pricing strategies, there is no one perfect solution.

The UK Ebook Market

The UK is the second-largest ebook market accounting for 15% of all English language ebook sales worldwide in 2017. Ebooks account for 34% of all book sales, and Amazon.co.uk takes over 87.9% of the sales.

There is a 20% VAT applied to ebooks in the UK (which is not applied to print). Last year people spent a whopping $405 million USD on ebooks, 82.8% of it on Amazon.

The Global Ebook Report points out that in 2013, every fourth book bought in the UK was an ebook. It's even more striking if we look at just adult fiction: 40% of book purchases were digital. The UK book market also works for exports, targeting Scandinavian countries, Germany, Ireland, Southeast Asia, and China.

Canada, Australia, and New Zealand Ebook Markets

Canada, Australia, and New Zealand are still big players in the English language ebook market. (New Zealand's sales are added to US numbers.)

Amazon’s market share is getting smaller compared to the US and UK with 57.2% and 60.6% respectively. And Kobo has almost 25% of the Canadian market, with 14.4% going to Apple Books.

Emerging Ebook Markets

There is nothing wrong with focusing on the US market since it's the biggest. However, consider growing markets out there.

In 2014 the US was the largest publishing market in the world holding 26%, followed by China (12%) and Germany (8%). The top six by value includes Japan, France, and the UK; the rest of the world has a share of 39%. This is a pretty impressive number: who would want to miss out on over 40% of potential sales?

Europe's recent economic crisis has affected most of its book markets, where countries have started moving towards ebooks.

Russia

70% of Russian readers read ebooks and 92% of these readers said they got their books “from the internet”, for free. By the way, online piracy in Russia is still legal which does play a part in the ebook industry. The market has seen difficult years with low sales and big publishing chains closing down. However, reading is still really popular where writers and intellectuals hold an important public role.

Apple, Google, and WHSmith have been present and active in Russian since 2012. However other alternatives seem to be more popular than readers from these big three. We suspect the market is going to be even more attractive for readers and publishers in the coming years.

The Russian Ebook Market in 2018 and Beyond

Publishing Perspectives had an interview with LitRes general director Sergey Anuriev. It shared how Russia’s ebook sector will more than double by 2020. Digital content be up to 15% of the overall market and will reach $90 million, continuing to grow.

The main challenge, just like in previous years, will be piracy. In fact, LitRes halted its LitRes Touch project due to piracy issues. Publishing Perspectives shared how manufacturers were not interested in investing in secure ereading devices along with legally operating ebook stores -- piracy is the norm.

Brazil

Amazon, Apple, and are present in Brazil, so we can have a fair picture of the Latin American market. Based on data from 2013, Amazon and Apple are head-to-head, each owning 30% of the market.

In 2014 the Brazilian government decided to distribute digital textbooks to public school teachers and students. They bought over 400,000 tablets, making Amazon one of its approved platforms along with its local platform Saraiva.

The CAPES federal organization purchased licenses and ebooks worth $71 million. The content was made available for university students free of charge. This resulted in an increased interest in the Brazilian market from big names including Wiley and Springer.

Looking Ahead in the Brazilian Ebook Market

Brazil’s recent economic troubles have affected the book market overall. But according to Publishers Weekly, there is hope for the ebook market.

German Bookwire captures more than 80% of the Brazilian traditional ebook market. They had a 64% growth last year and it's expected that another 22% growth will happen in 2018. Top trade publishers in Brazil are looking at around 7% of their revenues coming from digital.

China

China has overtaken America and is now the world’s biggest e-commerce market (Morgan Stanley). After Amazon launched in 2013, it became one of the most popular platforms along with China Mobile, China Unicom, and 360. In this market, publishers have to manage fixed prices for ebooks and CEB, China's domestic ebook format.

Mobile devices are almost exclusively preferred, as China is the world’s biggest market for smartphones. The country has a high percentage of readers reading fiction on device apps. In terms of content, the market is ruled by Shanda Literature, a platform for amateur writers.

Chinese Ebook Market in 2018-2019

The Chinese ebook market is booming, and young people are driving this growth. According to China Daily, the number of Chinese readers increased by nearly 30 million in 2018. And the majority of these readers were born in the 1990s and 2000s. This demographic prefers ebooks to print books; 46% of ebook readers in China were born in the 1990s.

But how has the Chinese book market fared in 2019?

In the first half of 2019, the Chinese book market went up by about 11% thanks to online retail sales. (Forbes) Although sales in physical bookstores dropped a bit, it appears that heavy discounts was an important factor in driving online book sales in 2019.

OpenBook's Rainy Liu told Forbes that online shoppers enjoyed a 40% book discount rate in the first half of 2019. That doesn’t include additional promotional activities such as double-discount specials, gifts offered with certain purchases, and coupons.

The data reflect the buying habits of Chinese book consumers. And according to the data, offering discounted prices is a sales tactic to consider.

Reach hard-to-access markets, including China and many more!

Kindle App Market Share

The now 10-year-old Kindle was the first widely available and affordable ebook reader with easy click-to-buy options. Instead of converting and transferring files, consumers can simply buy from the app and enjoy easy reading across all devices.

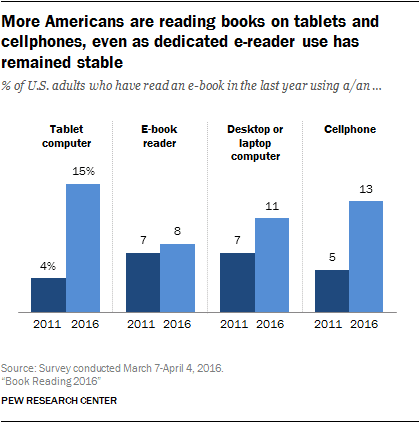

Great as it sounds, ebook readers are becoming a dying breed. In the US, the number of readers using a dedicated ebook reader has remained the same from 2011. Those reading on tablets, smartphones, or laptops grew a lot.

People would rather shop from their devices where there is the convenience of getting access to music, movies, tv shows, or original audio series on their devices.

The issue with syncing different formats and devices is no longer there with built-in apps, neither unique features. There's the issue of catalog size though, where millions of books are available from Kindle, Google Play or iBooks.

Going wide may mean more work, but good work is no surprise if you’re an independent worker. As billions of potential readers (or audio listeners) have yet to meet your content, we suggest using an aggregator company for help.

An aggregator like PublishDrive helps you manage all stores in one place. You can see pretty much everything related to your indie business on one dashboard and collect all your earnings from the same place. You also get additional administrative, marketing, sales reporting, and more publishing support.

To Sum Up:

The numbers don't lie, so we believe in publishing wide to as many retailers as possible. The Amazon market share is a very important consideration, but don't miss out on potential sales outside of just Amazon.

To reach global sales channels like the ones described above, sign up for a PublishDrive account for free. Manage distribution to 400+ stores for ebook, printing on demand, and audio via a single dashboard.