The Impact of Media Consolidation on the Publishing Industry

In an era where media giants continue to expand through mergers and acquisitions, the publishing landscape is undergoing unprecedented transformation. This consolidation trend affects everyone from multinational publishing houses to independent authors, reshaping how books are created, distributed, and consumed. For industry professionals navigating these changes, understanding the forces driving consolidation and its far-reaching consequences has become essential for survival and success.

The Evolution of Media Consolidation in Publishing

Historical Context

The publishing industry has experienced waves of consolidation throughout its history, but the pace and scale have accelerated dramatically in recent decades. What began as a landscape of numerous independent publishers has transformed into an industry dominated by a handful of major conglomerates.

In the 1960s, the United States had over 500 independent publishing houses. By the 1990s, mergers and acquisitions had significantly reduced that number. As detailed by John B. Thompson in Merchants of Culture, the 1980s and 1990s witnessed media corporations acquiring publishing houses to diversify and control intellectual property across various formats, including books, films, and others.

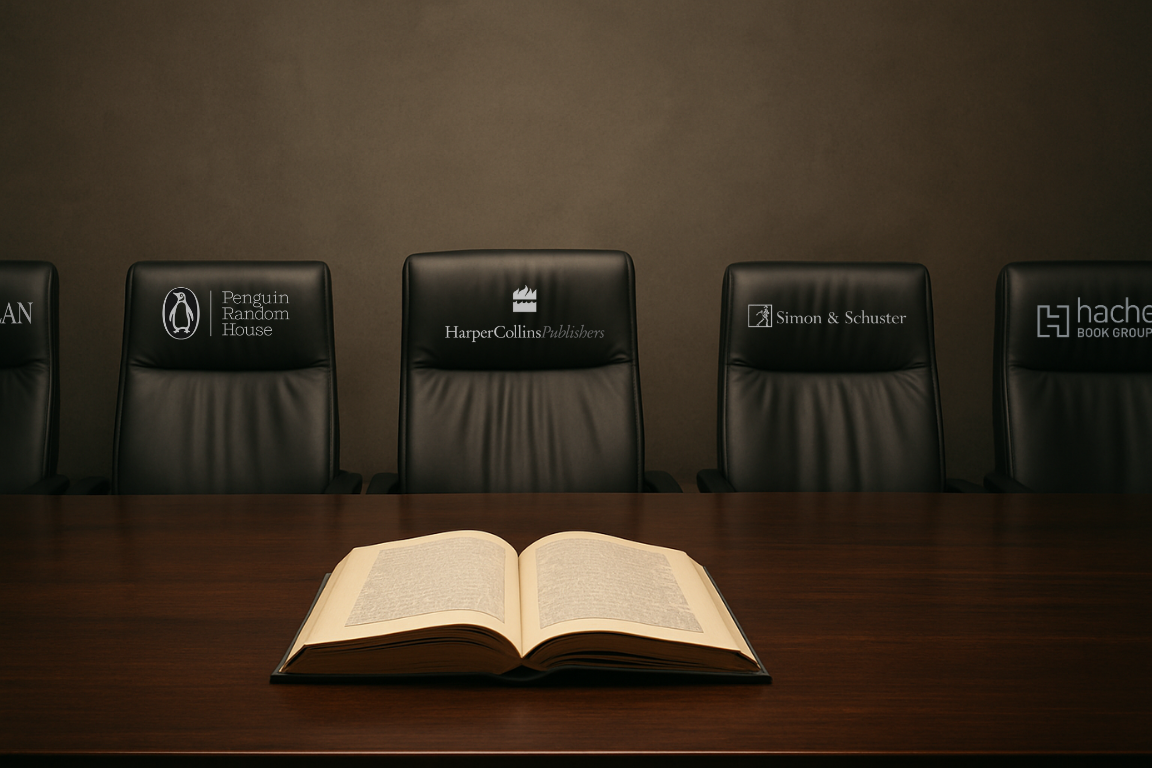

The “Big Five” Phenomenon

One of the most visible results of media consolidation has been the emergence of the “Big Five” publishing companies: Penguin Random House, HarperCollins, Simon & Schuster, Hachette Book Group, and Macmillan. These firms came to dominate the publishing industry through a series of acquisitions and mergers over several decades.

A key milestone was the 2013 merger of Penguin and Random House, which reshaped the global publishing scene. The merger reduced the “Big Six” to the “Big Five,” creating the world’s largest publisher.

Recent Developments

In 2020, Penguin Random House attempted to acquire Simon & Schuster for $2.18 billion. However, a U.S. judge blocked the merger in 2022 due to antitrust concerns, arguing it would harm competition and author compensation.

This decision reflected growing concerns about monopolistic practices in the publishing industry. Meanwhile, other entities, such as Amazon, have amassed a significant market share not by acquiring publishers, but by vertically integrating services like book printing, distribution, audiobook production, and publishing. Also, other tech companies like Spotify entered the audio market by acquiring audiobook aggregator, Findaway in 2021 after the Antitrust Agency analyzed their case.

Driving Forces Behind Media Consolidation

Economic Pressures

Many mergers are financially motivated. Traditional publishers struggle with shrinking profit margins, rising author demands, and the disruptive impact of digital media. Consolidation helps publishers pool resources, streamline operations, and expand into global markets more cost-effectively.

Technology and Innovation

Digital transformation has upended traditional publishing economics. Audiobooks and eBooks have expanded the market but require hefty investment in tech infrastructure. In 2022, audiobook revenue in the U.S. surpassed $1.6 billion, continuing a ten-year streak of double-digit growth.

Global Expansion

Consolidated publishing companies are better equipped to distribute books globally. According to the International Publishers Association, the global publishing market surpassed $90 billion in 2023, with growth in Asia, Latin America, and Africa offering lucrative opportunities. Larger publishers can localize content, establish regional partnerships, and negotiate favorable rights deals more effectively than smaller houses.

The Consequences of Consolidation for Publishers

Editorial Diversity at Risk

Critics argue that consolidation diminishes editorial diversity, with large publishers favoring commercially proven titles over experimental or marginalized voices. Fewer gatekeepers controlling the majority of book deals means fewer chances for unconventional works to get published.

Even when big publishers maintain multiple imprints to diversify their catalog, editorial decisions are increasingly influenced by corporate profitability targets, limiting innovation and risking cultural homogenization.

Author Royalties and Bargaining Power

With fewer major players to negotiate with, authors may find themselves at a disadvantage. The Authors Guild reports that median author income from book publishing in 2022 was only $10,000—a stark contrast to the billions the industry earns annually.

This imbalance has led many authors to seek better alternatives, from indie publishers to direct self-publishing platforms that offer more control and better royalty terms.

Organizational Strain and Cultural Clashes

Mergers promise operational efficiency, but cultural integration is often messy. According to McKinsey, around 70% of mergers fail to deliver expected value, with organizational misalignment and leadership turnover playing a major role.

When editorial staff, marketing departments, and back-office functions are merged or cut, the result can be decreased morale, workflow disruptions, and a loss of institutional knowledge.

Independent Publishers and the Rise of Self-Publishing

The Strength of Indie Publishers

While the Big Five consolidate, many small and medium-sized independent publishers continue to thrive. Organizations like the Independent Book Publishers Association represent thousands of small presses that serve niche markets with agility and care.

These publishers often publish work that large houses won’t touch—literary fiction, debut voices, experimental formats—and do so with leaner teams and stronger author collaboration.

Self-Publishing as a Response to Consolidation

The rise of self-publishing has been a game-changer. Authors are no longer dependent on traditional gatekeepers to launch their careers. With tools like PublishDrive, Kindle Direct Publishing, and Draft2Digital, writers can manage their own publishing operations and retain a higher percentage of royalties.

According to WordsRated, over 1.7 million self-published books were released in 2022 in the U.S. alone, and this number continues to rise. More authors are realizing that creative freedom and ownership outweigh the prestige of a traditional book deal.

Hybrid Models and Creator Economies

A middle ground has emerged: hybrid publishing, where authors pay for some services but benefit from professional production and distribution. Platforms like PublishDrive offer both independent and traditional publishers streamlined access to global markets with tools for metadata optimization, royalty management, and analytics—services once available only to major players.

As authors become more business-savvy and audiences follow creators across platforms, the creator economy in publishing continues to grow, offering an alternative path outside consolidated channels.

Global Perspectives on Media Consolidation

Europe

In countries like France and Germany, consolidation exists but is moderated by government policy. Fixed book pricing laws protect smaller retailers and publishers, ensuring competitive pricing and market diversity. However, major players like Bertelsmann still exert significant influence.

In the UK, HarperCollins UK and Hachette UK dominate the scene, mirroring U.S. trends.

Emerging Markets

In India, Brazil, and Nigeria, local publishers are consolidating to survive and expand against international competitors. In these markets, digital platforms often leapfrog traditional infrastructure, allowing for new models of collaboration, mobile-first publishing, and grassroots distribution.

Meanwhile, Chinese giants like China Publishing Group operate at immense scale, often supported by state funding, influencing global rights and translation markets.

The Technology Factor in Publishing Consolidation

Data-Driven Decision Making

Consolidated publishers increasingly rely on sophisticated data analytics to guide acquisition, marketing, and pricing decisions. Large publishers can afford to invest in proprietary algorithms and analytics teams that smaller publishers cannot match.

The most sophisticated publishers analyze everything from social media engagement to comparative sales patterns, creating detailed predictive models for new releases. These capabilities require substantial technology investments that favor larger, consolidated entities.

Direct-to-Consumer Relationships

As retail consolidation (particularly Amazon's dominance) has shifted power away from publishers, larger publishing houses have invested heavily in direct-to-consumer capabilities—another area where scale provides advantages.

Building effective direct relationships with readers requires sophisticated customer relationship management systems, marketing automation, and content delivery infrastructure.

For smaller publishers and authors without these resources, partnerships with service providers like PublishDrive have become increasingly valuable, offering access to distribution channels and reader analytics that would otherwise be unavailable.

Audiobook Production and Distribution

The audiobook boom represents both an opportunity and a challenge related to consolidation. Professional audio production requires significant upfront investment, with costs typically ranging from $5,000-$15,000 per title without AI involvement. With AI narration costs can decrease significantly which favors independent publishers who are more open to innovative solutions around book production.

Major publishers can amortize these costs across larger print runs and marketing budgets, while independent publishers and authors often struggle with the economics.

A significant example of digital publishing crossing borders with technology is Spotify's 2022 acquisition of Findaway, a leading audiobook distributor and production platform. This merger faced antitrust scrutiny from both U.S. and European regulators concerned about vertical integration in the audio content market. The UK Competition and Markets Authority (CMA) conducted an in-depth investigation before ultimately approving the deal with specific. This case illustrates how digital publishing consolidation increasingly involves tech platforms rather than traditional publishers, creating new regulatory challenges as industry boundaries blur.

Innovative partnerships and technology platforms are beginning to address this imbalance. Services that connect narrators directly with publishers and authors, AI narration solutions along with distribution platforms that reach beyond Audible, are creating more opportunities for audio content from smaller entities to reach the market.

Regulatory Perspectives and Future Directions

Antitrust Enforcement

The blocked merger between Penguin Random House and Simon & Schuster signaled potentially increased regulatory scrutiny of publishing consolidation. This decision hinged not just on consumer impact but on the merger's effect on author compensation—a novel interpretation of antitrust concerns in this industry.

Legal experts suggest this could represent a shift in how consolidation is evaluated going forward. According to the American Antitrust Institute, there has been a broader movement toward more aggressive antitrust enforcement across media industries since 2021, potentially limiting future mega-mergers in publishing.

International Regulatory Differences

Regulatory approaches to publishing consolidation vary significantly across jurisdictions. The European Union generally applies stricter merger control than the United States has historically, particularly regarding cultural industries like publishing.

Countries like France, Germany, and South Korea maintain various protections for their publishing industries, including fixed book price laws, cultural subsidies, and targeted regulations that limit certain forms of consolidation. These policies create different competitive dynamics than in more market-oriented environments like the United States and United Kingdom.

Future Consolidation Patterns

Industry analysts predict that while mega-mergers may face increased regulatory scrutiny, consolidation will continue in different forms:

- Vertical integration (publishers acquiring printing, distribution, or retail capabilities)

- Media cross-ownership (traditional publishers merging with streaming services or podcast networks)

- Technology acquisitions (publishers purchasing ed-tech platforms, analytics companies, or content management systems)

- Geographic expansion (western publishers acquiring companies in emerging markets)

These evolution patterns suggest that the publishing landscape will continue to transform, even if the pace of horizontal consolidation among major houses slows.

Strategic Responses for Industry Participants

For Traditional Publishers

Publishers confronting the consolidation trend must consider several strategic responses:

- Specialization in underserved niches where larger entities struggle to compete effectively

- Investment in direct-to-consumer capabilities to reduce dependency on consolidated retail channels

- Development of multimedia rights strategies that leverage intellectual property across formats

- Strategic partnerships with technology providers to access capabilities without building in-house

- Exploration of alternative business models beyond the traditional advance-and-royalty structure

Medium-sized publishers face particularly difficult choices—either grow through selective acquisitions or focus on distinctive specialization that justifies their independence.

For Authors and Indie Publishers, Content Creators

Authors navigating this consolidated landscape should consider:

- Building direct relationships with readers through newsletters, social media, and personal websites

- Exploring hybrid publishing approaches that combine traditional and independent elements

- Developing expertise in rights management to maximize revenue across formats and territories

- Partnering with service providers like PublishDrive that offer professional tools without surrendering creative control

- Considering different publishing strategies for different works based on commercial potential and creative goals

The most successful authors increasingly view themselves as entrepreneurs managing a portfolio of intellectual property across multiple channels and formats.

For Retailers and Distributors

Book retailers and distributors must respond to both publisher consolidation and the dominance of Amazon:

- Developing specialty knowledge and curation that algorithms cannot easily replicate

- Building community through events, recommendations, and personalized service

- Exploring cooperative models that increase collective bargaining power

- Investing in direct sourcing from independent publishers and authors

- Partnering with platforms like PublishDrive that aggregate diverse content from multiple sources

Independent bookstores, in particular, have demonstrated remarkable resilience by focusing on community building and experiential retail that online giants struggle to match.

Conclusion: Navigating the New Publishing Landscape

Media consolidation is not inherently negative—it can bring investment, innovation, and global reach. But unchecked, it can also narrow access, stifle competition, and marginalize voices that don’t meet mainstream criteria.

For publishers and authors alike, the key lies in strategic adaptation. Embracing digital transformation, investing in direct reader engagement, and seeking out flexible, tech-forward partners can provide resilience amid industry shake-ups.

At PublishDrive, we believe in empowering publishers and authors of all sizes to thrive—regardless of consolidation trends. With global distribution, AI-driven tools, and transparent royalty reporting, we help our partners navigate the future of publishing with confidence.