April 2020 Book Market Update: Best Genres & More During COVID-19

COVID-19 has affected communities of every size and function; from large institutions to small businesses, and also the publishing industry. There can be lots to worry about especially those who come from traditional publishing. But uncertain times can also mean new opportunities, aka new book sales for you.

Below we go over the trends and data in this ever-changing market, key in seeing what’s selling digitally these days. We specifically focus on book sales in April 2020 (check out last month’s report to also learn more about our reporting methodology). Plus, we give an overview of international digital book sales and popular book genres.

Check back because we’ll be updating this study every 20th of the month. And if you’re free on May 21st, join our free webinar where we discuss trends in depth. All in all, we hope you keep up with the newest developments and make the best-informed decisions in your book publishing endeavors.

Digital book sales continue to rise.

During this pandemic shutdown, people want more at-home entertainment, prioritizing digital means to get them. Things like movie-streaming services, video games, and of course books are seeing a significant boom. This trend was dominant in March and continued into April this year.

On PublishDrive, online book sales increased by 23% in April compared to March. In March, we saw a 20% growth across markets and stores. If we compare our sales data to last year’s from the same period, that’s a 43% increase in sales.

These growing sales numbers are super beneficial for PublishDrive indies who keep 100% royalties. Since we don’t take any commission, publishers get the same royalties as selling directly to stores. All this growth is 100% theirs.

As the COVID-19 curve flattens in more areas, countries are slowly opening up from lockdowns. We are paying attention to see what and how trends may change in May. Based on a mid-month report, so far, book sales are still looking strong in May compared to last year.

Non-fiction, romance and thriller genres are growing continuously.

With digital publishing, our bestseller list of book categories has usually been comparable to other statistics on book sales. Popular genres included fiction especially romance, fantasy, thriller, and crime books. Nonfiction self-help titles maintained solid performance as well.

In March, we saw a shift in consumer behavior with the rise of educational content and YA categories. These categories were still popular in April, but their growth has flattened.

We did see significant growth from nonfiction categories including business, health & fitness, and self-help. In fiction, the biggest winners were romance (including erotica), thriller, literary, and fantasy books.

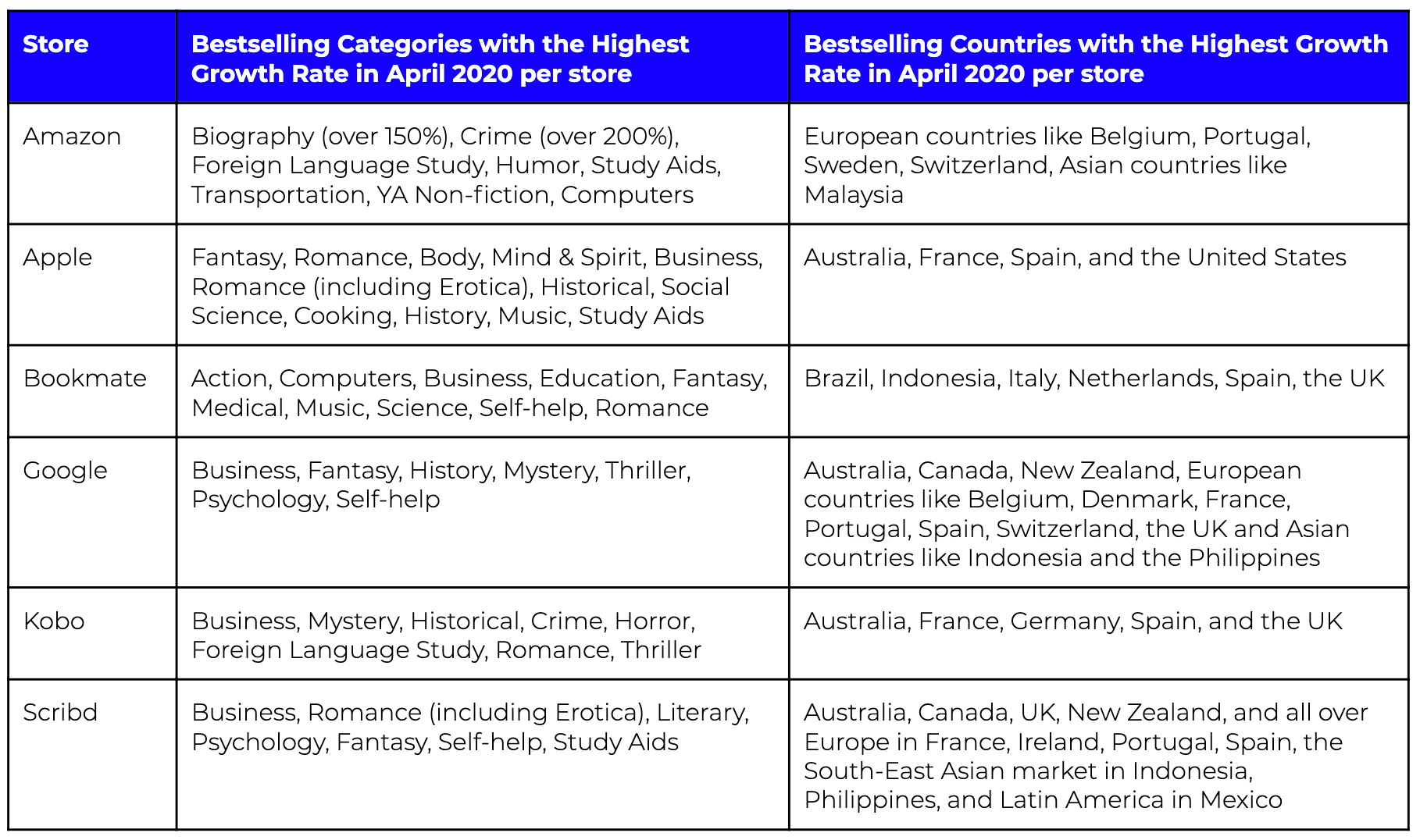

We looked at PublishDrive’s bestselling book genres and countries with the highest growth rates from stores and pulled this table for your viewing:

The US market grew, but international book sales are growing exponentially.

Along with a dominant presence in the US market, publishers get a huge international reach with PublishDrive. Right now, English language books are in global demand. Sales from the US grew by 11% in April, but interestingly, when we look at its ratio from the overall sales, it shrunk from 35% in March to 32% in April. This shows the impact of rapid growth from international markets.

See the chart below with the top 10 bestselling countries and their growth rates from March to April 2020.

The US and UK are top countries based on sales value, and sales are increasing month by month. Other countries also stand out: Australia, Canada, New Zealand, European countries like Belgium, France, Spain, Switzerland, Latin America like Brazil and Mexico, Asian countries like India, Indonesia and the Philippines. As countries reacted to COVID-19 with different lockdown periods and measurements, we’ve seen new markets for English language content pop up. If you are interested in a more detailed country analysis, download the free report below.

Spike in sales from subscription services and device-related retailers.

Book royalties come from different sources today, not just from selling one copy to a consumer. Typically, these sources can be categorized as follows:

- Retail: Major outlets that reach global readers with the usual one copy purchase business model. E.g. Amazon, Apple Books, Barnes & Noble, Google Play Books, and Kobo.

- Subscription services: Usually applications or stores that provide unlimited access to books in exchange for a monthly subscription fee. E.g. Scribd, Bookmate, and Dreame.

- Digital library providers: Book borrowing for not just individuals, but institutions like public libraries, schools, universities, or corporate libraries. E.g. OverDrive, Bibliotheca, Mackin, and Odilo.

- Regional stores: Outlets that cover a specific region that serves the local community. E.g. Tolion, Chinese stores, Hungarian outlets, and German network.

With book sales, many think of selling ONLY with Amazon. Although Amazon is great, there’s an entire mass of readers you can find elsewhere with other stores and business models.

56% of PublishDrive’s book sales come from retail (Amazon included). The other 44% comes from subscription business models (35%), libraries (0.6%), and regional stores (7.4%). This also shows how reader experience has shifted in the last couple of years.

More people are participating via subscription services or even book reading institutions. International book sales own 7.4% of the overall book sales on PublishDrive.

We’ve also seen trends in ratios according to different business models, see chart below. Regional stores grew the most by 23%, telling us that people looked to local stores for digital books first.

Subscription models also increased by another 26% in April compared to 25% in March. Subscription services captured a larger piece of the pie than in March. Many of them cover different products: books, audiobooks, music, or even movies.

The countries where subscription services seem to be catching up are Australia, Brazil, Canada, France, Germany, Ireland, New Zealand, Romania, Spain, Switzerland, Turkey, and the UK. For example, Scribd just ran a promotional campaign where they extended its free trial period allowing more readers to join without any financial restrictions.

Retailers grew by 19%, above the usual trend based on last year’s data. Retailers’ growth was dominant in Australia, Belgium, Canada, France, Indonesia, Mexico, Philippines, Portugal, Romania, Spain, UK, US, and South Africa.

When looking at the biggest growth numbers behind some of the stores, we found that the biggest winners were subscription services and stores with mobile/tablet device-related apps, see chart below. Apple and Google are growing full speed ahead since March, hitting over 30% in April.

Apple and Google are unique in the ebook market as their book reading apps and stores are preinstalled on a large amount of devices worldwide. So whoever has an iPhone or Android can access different types of books easily with their preinstalled apps. The outstanding growth is understandable during this period with the plethora of device type and usage out there.

Among countries for Apple sales, the biggest growth came from Australia, France, Spain, and the United States. Sales in the Google Play Books store spiked in countries like Australia, Canada, New Zealand, European countries like Belgium, Denmark, France, Portugal, Spain, Switzerland, the UK and Asian countries like Indonesia and the Philippines. Kobo grew by 20%, and especially in international markets like Australia, France, Germany, Spain, and the UK.

When it comes to subscription services, Scribd, Bookmate, and 24 symbols grew above 20%. Scribd’s growth was remarkable in English speaking countries like Australia, Canada, UK, New Zealand, and all over Europe in France, Ireland, Portugal, Spain, the South-East Asian market in Indonesia, Philippines, and Latin America in Mexico.

So how’s the book market doing? Very well when it comes to digital.

We hope you found this insightful. Remember to come back on a monthly basis to see what’s happening in the book market. Also, don’t forget about our upcoming free webinar where you get the chance to ask more about the book market, how to sell more books, and anything else about digital publishing: register here.

If you’d like to read more about the country highlight from our report, you can download it below.