Audiobook Pricing & Royalties: How to Protect Margin and Still Grow Reach

We've covered the explosive growth of audiobooks, consumer behavior patterns, what's actually selling, and why going wide matters. Now let's talk about the part that keeps you up at night: are you actually making money?

After analyzing distribution data across thousands of titles at PublishDrive, I've learned that audiobook economics work fundamentally differently from ebooks or print. The pricing models are counterintuitive, the royalty structures vary wildly by platform, and what seems like a great deal can quietly drain your profitability.

Let's break down the math so you can make smarter decisions about pricing, distribution, and where to focus your marketing efforts.

Retail vs. Streaming: Two Completely Different Business Models

Pro authors and publishers first need to understand that audiobook revenue comes from two fundamentally different models—and mixing them up is expensive.

Retail platforms (Audible, Apple Books, Google Play, Kobo) sell audiobooks as individual purchases. Think of it like selling an ebook: one transaction, one payout, straightforward math. Royalty rates typically range from 25% to 40% depending on exclusivity, pricing, and distribution agreements.

At Audible specifically, you'll earn around 40% royalty if you're exclusive through ACX, or roughly 25% if you distribute non-exclusively (which you can do through aggregators like PublishDrive or Findaway Voices). The catch? Audible also uses a credit system where subscribers pay $14.95/month for one credit, meaning your $25 audiobook nets you the same royalty as a $10 one if purchased with a credit.

Streaming platforms (Spotify, Scribd, Storytel, Nextory) operate on a completely different model. These are subscription services where listeners pay a flat monthly fee for unlimited access. You're not paid per sale—you're paid per listen, typically calculated by either listening time or a percentage of subscription revenue allocated by engagement.

Rates vary widely but generally fall in the $0.005–$0.02 per minute listened range, depending on the platform, territory, and subscription tier. A 6-hour audiobook fully consumed might earn you anywhere from $1.80 to $7.20. Yes, you read that right—sometimes less than a single Kindle Unlimited page read payout per complete listen.

The strategic implication? Streaming is a volume game. You need thousands of listens to match what one retail sale generates. But streaming also offers discovery and reach you can't get on retail-only platforms, especially in non-English markets where Storytel and similar services dominate.

Non-Exclusive Flexibility: Why Locking In Isn't Always Smart

Here's where entrepreneurs and tech-minded publishers have an advantage: you understand opportunity cost.

ACX's exclusive deal offers 40% royalty rates and promotional tools, but requires you to pull your audiobook from everywhere else for seven years. That means no Spotify. No international platforms. No library sales through Overdrive. No experimenting with subscription services in Scandinavia, where audiobook consumption rivals the U.S.

Going non-exclusive through PublishDrive or similar aggregators typically nets you 25% on Audible, but opens up 20+ additional platforms globally. The break-even question becomes: will those additional platforms generate enough revenue to compensate for the 15% royalty difference on Audible?

From our data, the answer increasingly is yes—especially if you're:

- Publishing in languages beyond English (where regional platforms outperform Audible)

- Writing in genres with strong streaming audiences (romance, mystery, fantasy)

- Building a backlist where discovery matters more than launch velocity

- Willing to promote across multiple storefronts actively

PublishDrive's multi-platform analytics let you track performance by retailer, region, and format in one dashboard, making evaluating whether wide distribution is paying off for your specific titles significantly easier.

Price vs. Length: The Unwritten Rules

Audiobook pricing isn't arbitrary, but it's not standardized either. The industry has developed some loose rules of thumb based on listening time:

- Under 3 hours: $7–$12

- 3–7 hours: $12–$20

- 7–12 hours: $18–$25

- 12+ hours: $25–$35+

Pricing too high relative to length triggers sticker shock and reduces conversion. Pricing too low signals poor quality and can hurt discoverability in algorithmic recommendations.

The sweet spot for most fiction is $1.50–$2.50 per hour of content, which aligns with listener expectations and platform norms. For non-fiction, especially business and self-help, you can stretch closer to $3–$4 per hour if the perceived value is high.

But here's the twist: pricing strategy also affects your marketing eligibility on Audible. Your audiobook must be priced within specific ranges relative to length to run certain promotions. Price it wrong, and you lose access to promotional tools that could 10x your visibility.

Promo Pricing: The Hidden Revenue Lever

Smart publishers treat promotional pricing as a core strategy, not a last resort.

Temporary price drops—especially coordinated with email campaigns, social ads, or seasonal promotions—can dramatically boost sales velocity, which improves algorithmic visibility long after you return to full price. A well-timed $0.99 sale on an audiobook paired with social proof (reviews, rankings) often leads to sustained elevated sales at $19.99.

Platform-specific promo opportunities to leverage:

- Audible Daily Deals (application-based, massive exposure if selected)

- Chirp deals (Bookbub's audio platform, highly effective for discovery)

- Apple Books promotions (powerful during new release windows)

- Scribd featured placements (negotiable through aggregators)

PublishDrive makes scheduling and coordinating price changes across multiple platforms easy—critical for time-sensitive campaigns where 48-hour delays can kill momentum.

PublishDrive helped its indies generate an extra 20,000 copies sold through in-store promotion opportunities. Some of the most interesting campaigns ended in the following metrics on Apple as one of the top partners of PublishDrive:

Perma-frees Highlights by Apple Books (May 1-31, 2025)

Combine this with targeted ads on platforms like BookBub, Written Word Media, or Facebook, specifically highlighting the limited-time audio price, and you've got a proven formula for both revenue spikes and long-tail visibility improvements.

Break-Even Calculator: A Simple Example

Let's work through realistic math for an 8-hour audiobook to see profitability.

Production costs (estimated):

- Professional narration: $200–$400 per finished hour = $1,600–$3,200

- Alternatively, royalty share (50/50 split with narrator, $0 upfront)

- Or AI narration: $50–$300 flat fee depending on service quality

Revenue scenario (non-exclusive, priced at $19.99):

Retail sales:

- Audible: ~25% ($5.00 per $19.99 sale directly or $4 per sale with a typical aggregator)

- Apple Books: ~35% net ($7.00 per sale with typical aggregator)

- Google Play: ~35% net ($7.00 per sale with typical aggregator)

Streaming (if available on Spotify/Scribd):

- Average payout: ~$0.01/minute × 480 minutes = $4.80 per full listen

Break-even analysis:

If you paid $2,400 for production:

- You need ~480 Audible sales directly or 600+ sales through an aggregator, OR

- ~343 Apple/Google sales, OR

- ~500 complete streaming listens directly or 625+ through an aggregator, OR

- Some combination thereof

With PublishDrive, you can get to breakeven earlier as PublishDrive does not take the additional 15-20% of the store sales. So the math would add up the following with PublishDrive:

Retail sales:

- Audible (25% royalty): $5.00 per sale

- Apple Books (PublishDrive payout: 45% net): $9.00 per sale

- Google Play (PublishDrive payout: 50% net): $10.00 per sale

Streaming (if available on Spotify/Scribd):

- Average payout: ~$0.01/minute × 480 minutes = $4.80 per full listen

Break-even analysis:

If you paid $2,400 for production:

-

- You need ~480 Audible sales, OR

- 240-266 Apple/Google sales OR

- ~500 complete streaming listens, OR

- Some combination thereof

PublishDrive enables authors to break even on Apple or Google, with approximately 100 fewer volumes sold than other platforms.

Seems daunting? Here's the reality: a strategically marketed audiobook can hit these numbers in 6–18 months if you're actively building your list, running periodic promos, and leveraging multiple platforms. Backlist titles continue earning long after break-even, making audio increasingly profitable.

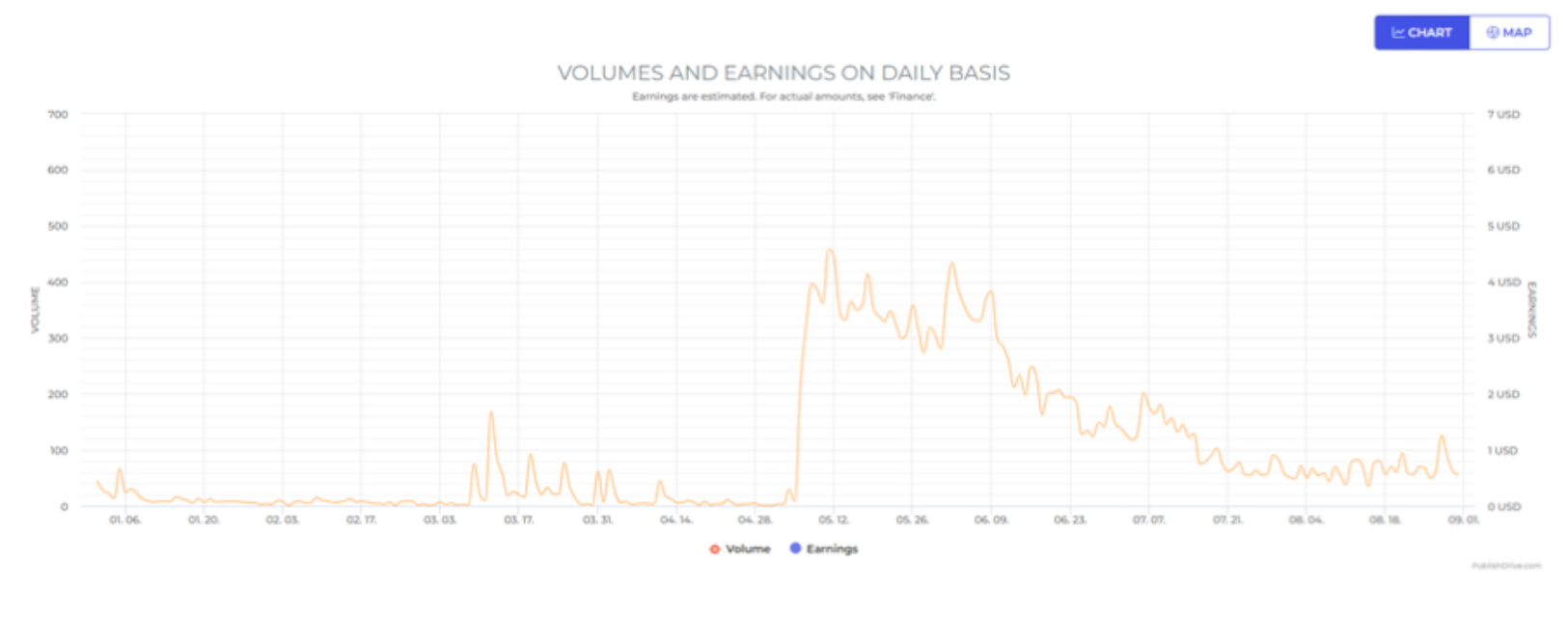

PublishDrive's revenue analytics show exactly where your sales are coming from, helping you double down on what's working and cut what isn't. If Apple Books is outperforming Audible 3:1, you know where to focus your marketing budget.

The Bottom Line: Distribution Strategy Is Financial Strategy

Audiobook economics reward strategic thinking over guesswork. The publishers and authors seeing real ROI are those who:

✅ Understand platform-specific math and choose distribution models accordingly

✅ Price intentionally based on length, genre expectations, and promotional eligibility

✅ Leverage promotional pricing as a growth tool, not a panic button

✅ Track performance religiously to identify which platforms justify marketing spend

✅ Think in portfolio terms—audio profitability comes from sustained backlist, not single titles

The beauty of modern audio distribution is that you don't have to guess. Platforms like PublishDrive give you real-time visibility into what's working, where your audience is, and which revenue streams are worth your energy.

Going wide isn't just about reach—building sustainable, diversified income that doesn't disappear if one retailer changes its algorithms or terms.

Ready to make smarter audio decisions?

Start now and see exactly where your audio revenue comes from.

Use PublishDrive's analytics to track ROI across channels, test pricing strategies, and identify your most profitable distribution mix. In audio, gut feeling costs money, but data makes it.

SIGN UP NOW