Amazon Ebook Market Share 2017-2024

Why sell Amazon ebooks? Because Amazon’s market share is significant around the globe. Amazon KDP (Kindle Direct Publishing) is the place to be when selling ebooks. But is this reason enough to go exclusive and not publish-wide? Here's what to know.

Key takeaways

- While Amazon is a major player in ebook sales, it's not the only one. By publishing wide on other platforms, you can reach more readers and potentially increase your earnings.

- Ebook readers are becoming less popular, but digital book sales are still on the rise. This means there are new opportunities for authors to reach readers around the world.

- Aggregator services can help you distribute your ebooks to multiple platforms with ease. This can save you time and effort, and help you reach a wider audience.

This write-up goes over:

I. The Amazon Hook

You can sell books on Amazon, a store leading e-commerce sales in online shopping.

The platform has Amazon Prime with free two-day delivery and perks like the ebooks Kindle unlimited Prime reading, deals for bestsellers, more Kindle books, etc.

However, when looking at global ebook publishing, new stores, and business models are emerging quickly.

🔥 Read more about different business models in publishing and why selling your books internationally is better than staying exclusive to Amazon.

Truth is, as an Amazon exclusive, you are losing potential readers and earnings. Amazon’s ebook market share is just a piece of this wide and lucrative pie.

Kindle Market Share

Kindle was the first affordable ebook reader with easy click-to-buy options. Instead of converting and transferring files, consumers could buy the app and enjoy easy reading across all devices.

Now, ebook readers are becoming a dying breed. The number of readers using a dedicated ebook reader in the US is forecasted to decrease by 2027. Those reading on tablets, smartphones, or laptops grew a lot.

Data collected concerning the e-reader market size shows a decrease from $396.4 million in 2021 to a presumed $204.7 million in 2027.

The issue with syncing different formats and devices is no longer there with built-in apps. Size catalog continues to matter, however, millions of books are available not just on Amazon but also on Google Play or iBooks.

Going wide may mean more work, but this is no surprise if you’re an independent worker. Aggregator companies bridge the gap to billions of potential readers (or audio listeners) yet to meet your content.

A subscription-based aggregator like PublishDrive helps you manage all your stores in one place. You can see everything related to your indie business on one dashboard and collect all your earnings from the same place.

🔥 If you are unsure of your earnings regarding subscription vs royalty share models, use our Calculator to get a better picture. Here’s how it works.

II. Amazon Ebook Market Share Throughout the Years

We used PublishDrive to collect data from recent years to see what percentage of the book market Amazon captures and learn more about what makes an author more competitive.

Here are our findings into opportunities that authors miss when strictly following Amazon book sales statistics.

1. Market outlook

Book royalties come from different sources today, not just from selling one copy to a consumer. Typically, these sources can be categorized:

- Retail: Major outlets that reach global readers with the usual one-copy purchase business model. E.g., Amazon, Apple Books, Barnes & Noble, Google Play Books, and Kobo.

- Subscription services: apps or stores that provide unlimited access to books in exchange for a monthly subscription fee. E.g., Scribd, Bookmate, and Dreame.

- Digital library providers: book borrowing for individuals and institutions like public libraries, schools, universities, or corporate libraries. E.g., OverDrive, Bibliotheca, Mackin, and Odilo.

- Regional stores: outlets that cover a specific region and serve the local community. E.g., Tolino, Chinese stores, Hungarian outlets, and German network.

Here are the benefits of publishing globally to more stores:

- Get the discoverability your content deserves, especially in Google searches. If you look at just Android devices, that's 2.5 billion potential readers you miss by selling exclusively on Amazon. Listing your content in multiple places enhances your Google search ranking.

- Access plenty of marketing perks with other stores. For example, you can send free review copies on Apple and Google with PublishDrive.

- There’s less risk by setting up more streams of income. It can help keep your business afloat, especially during unpredictable times. Increase your selling potential by adding audiobook or print-on-demand versions of your books to capture more readers.

With digital book sales on the rise almost everywhere, international markets want English-language content.

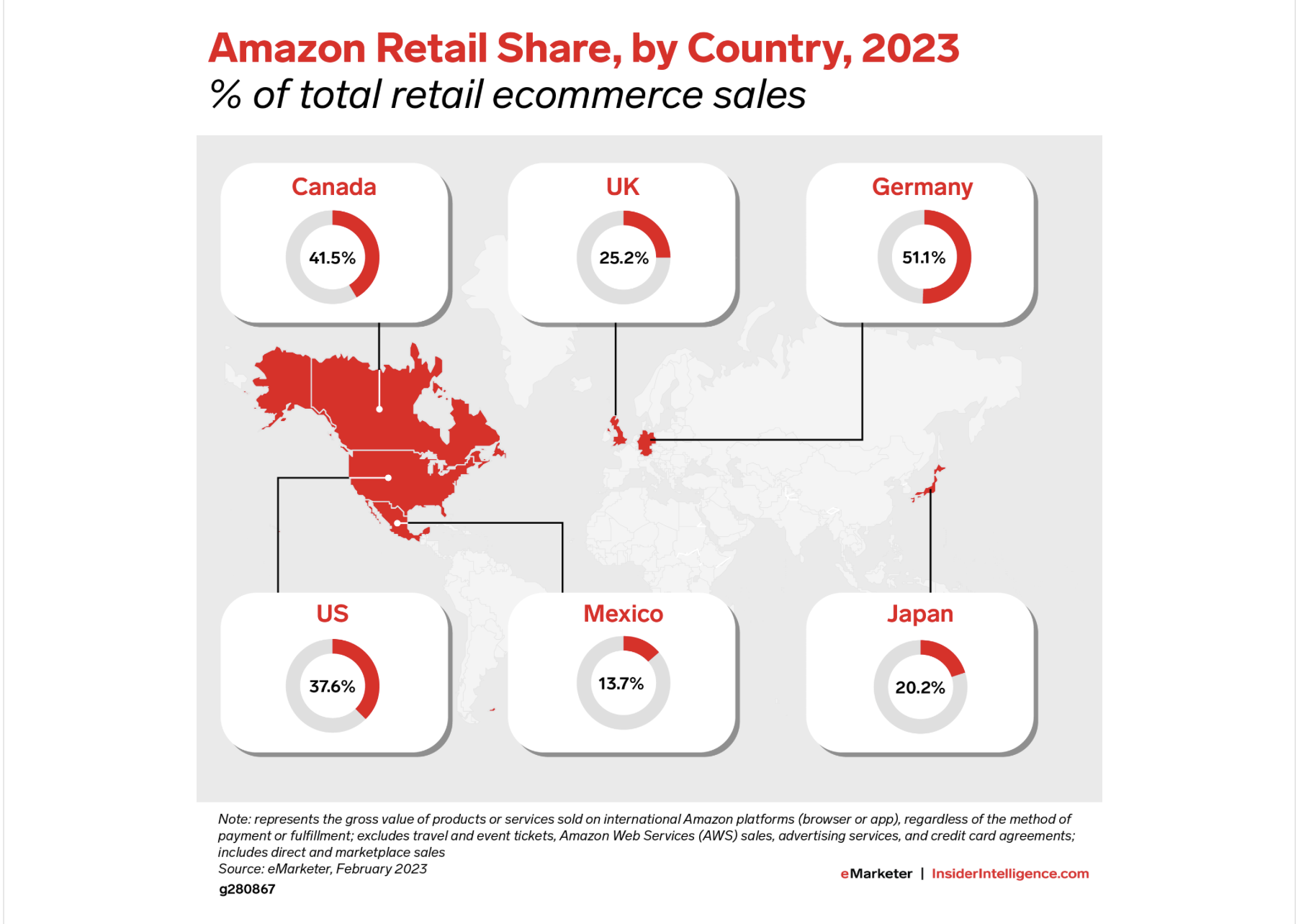

2. 2023 Amazon market share

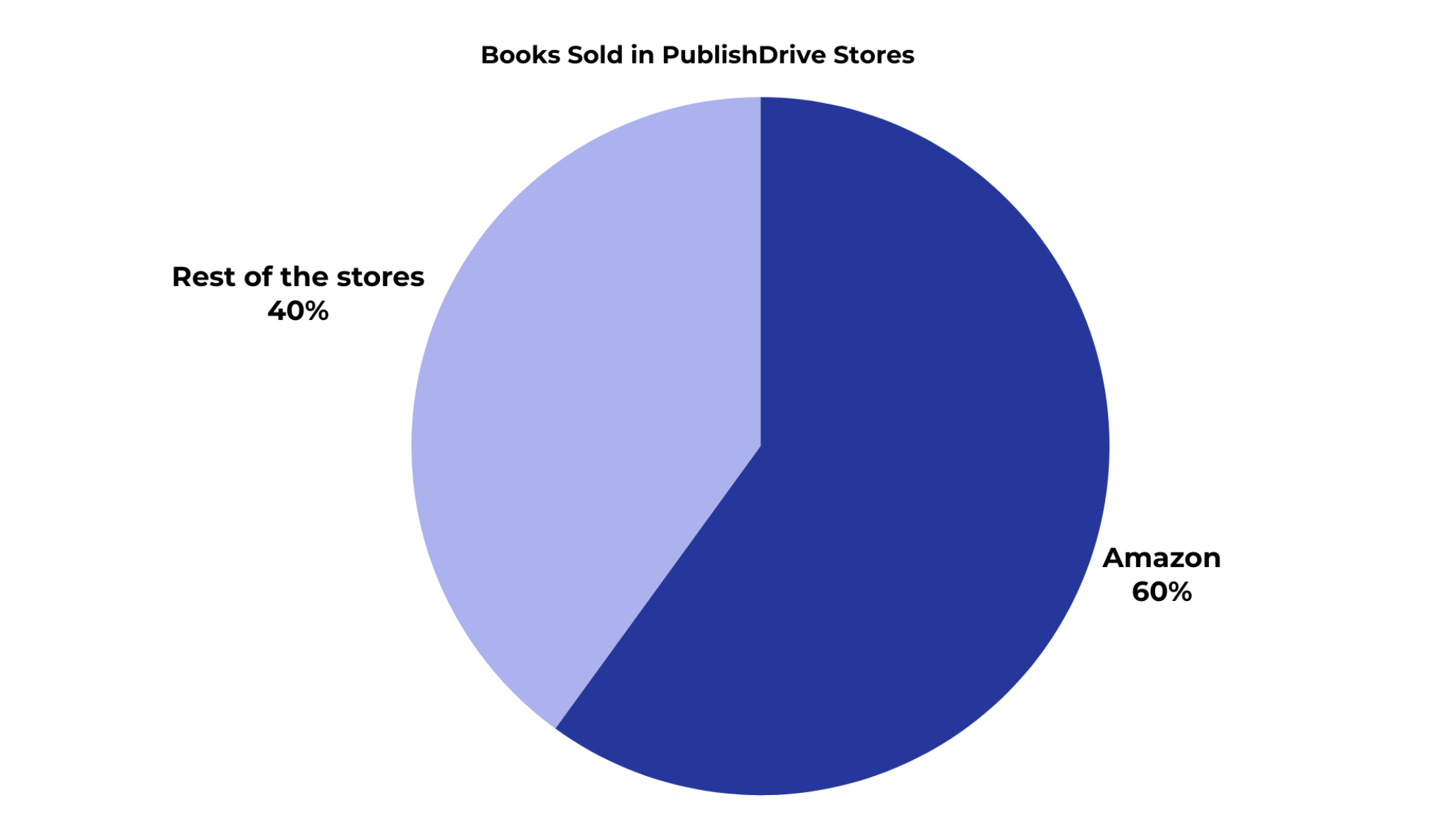

The 2023 sales data showed that 40% of total book sales occur outside of Amazon. This is why authors and publishers should consider broadening their distribution channels.

Authors who restrict their sales to Amazon alone miss out on approximately 40% of potential royalties that could be earned by expanding to other platforms.

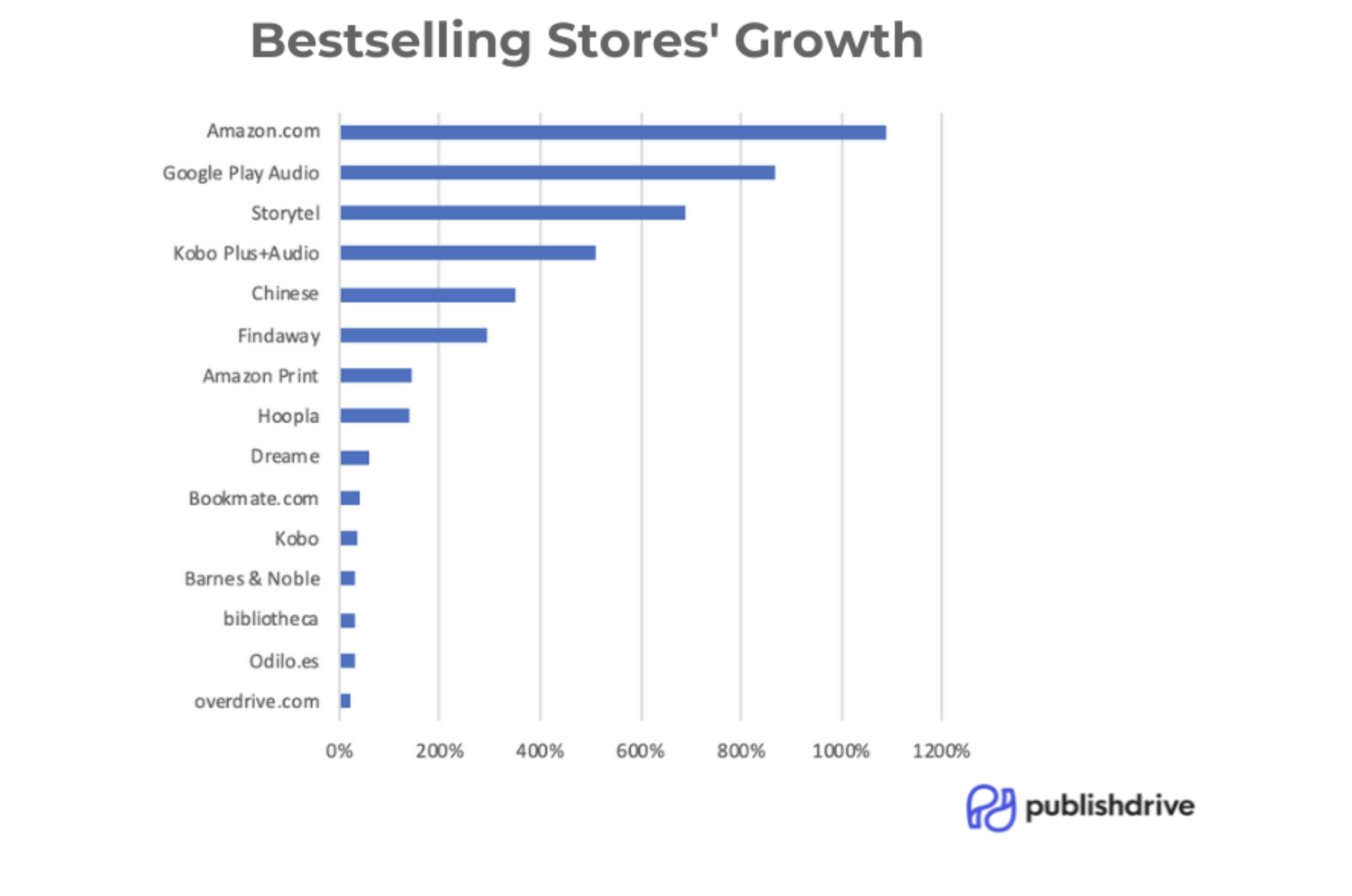

When it comes to the growth of the main distribution channels, while Amazon leads the way, there are other avenues for authors to discover. Key players appear each year, and momentum should be seized.

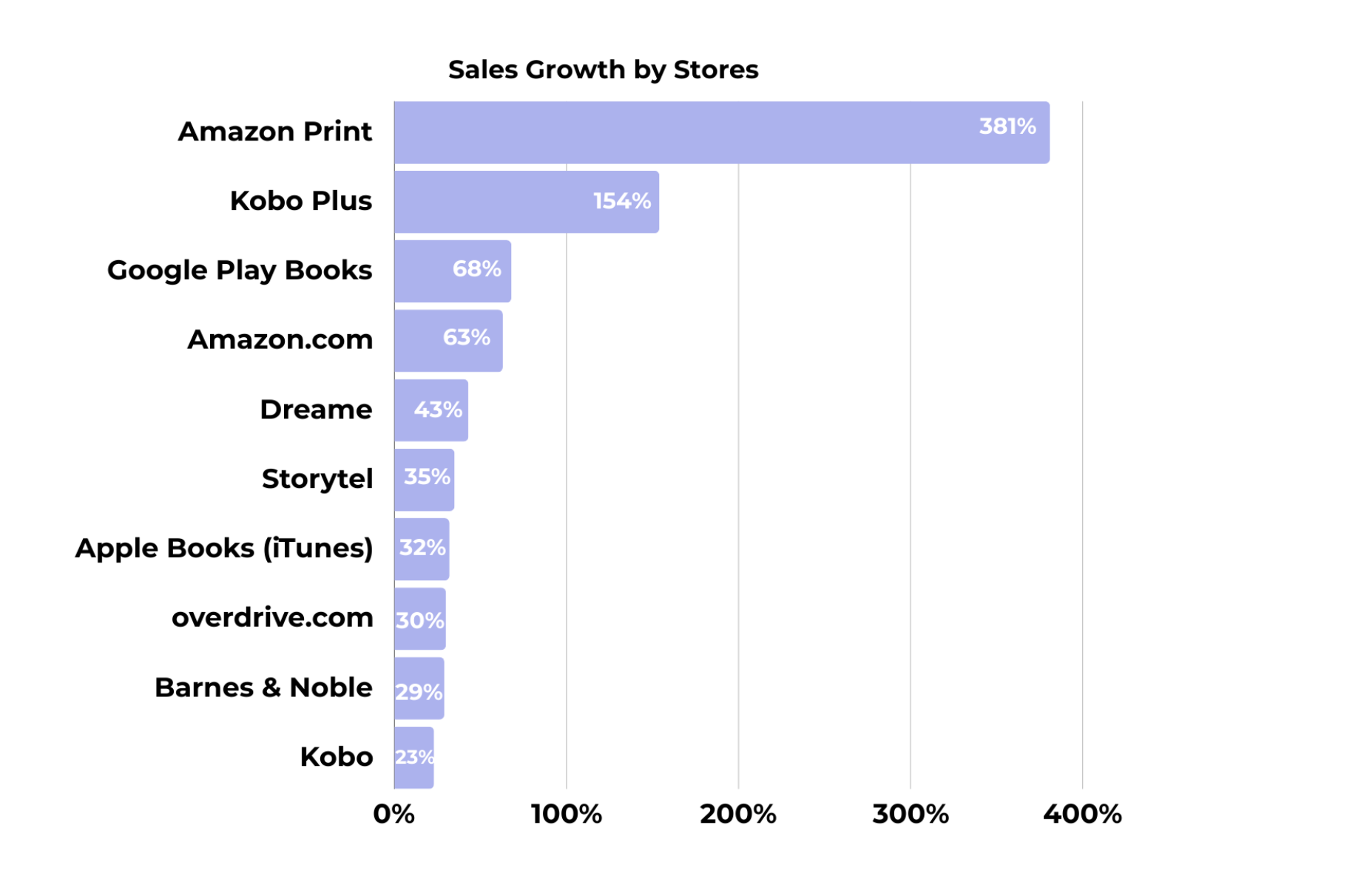

Kobo Plus had a 154% increase in 2023 compared to 2022. Authors confirmed the influence Kobo and Kobo Plus had on their royalties.

3. 2022 Amazon book sales statistics

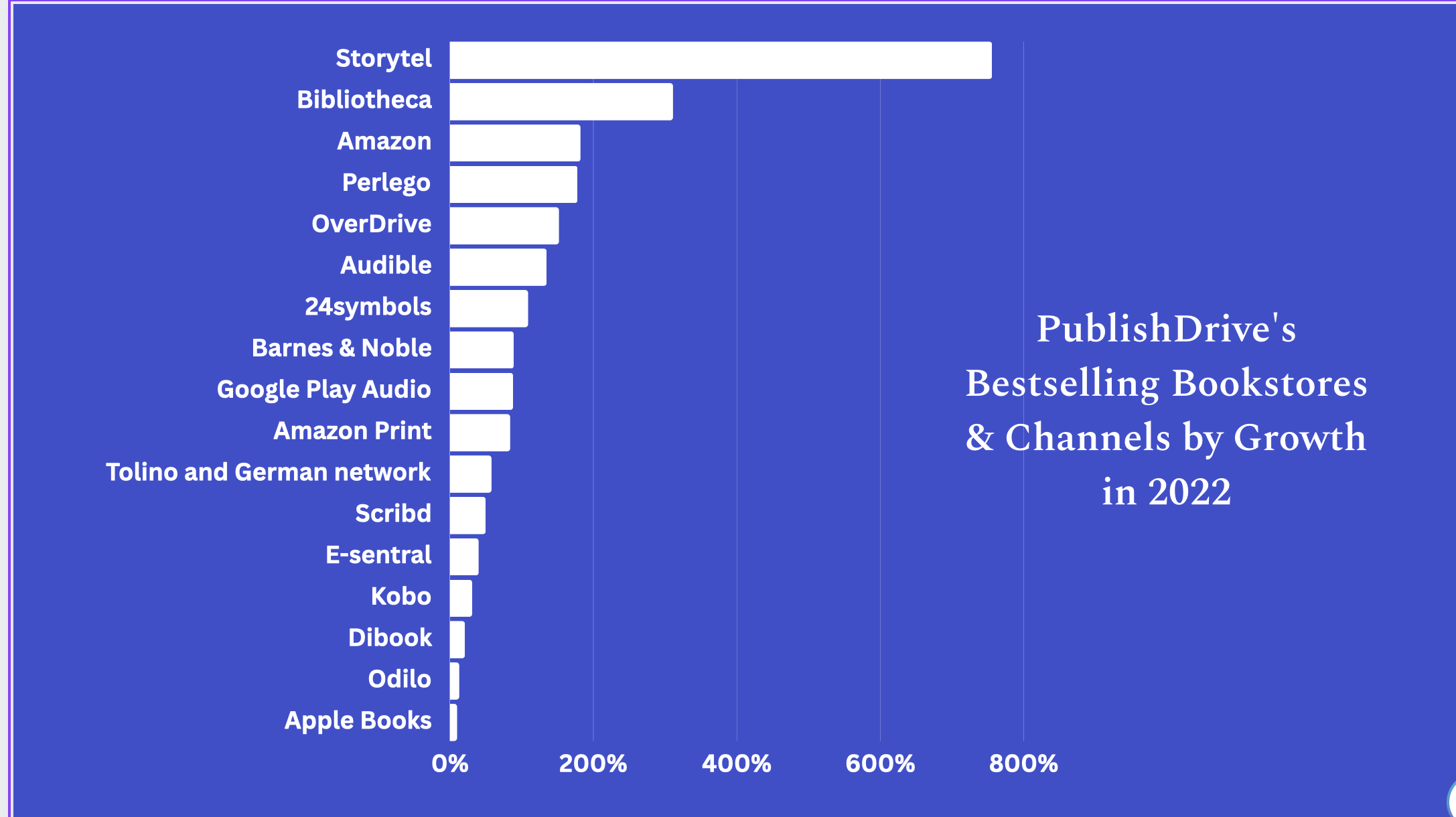

PublishDrive’s indie book sales grew by 200% in 2022 compared to the year before (for a consecutive year!).

While Amazon remained a significant platform for distribution and sales, with an 182% increase compared to 2021, new channels impacted the revenue streams of PublishDrive authors.

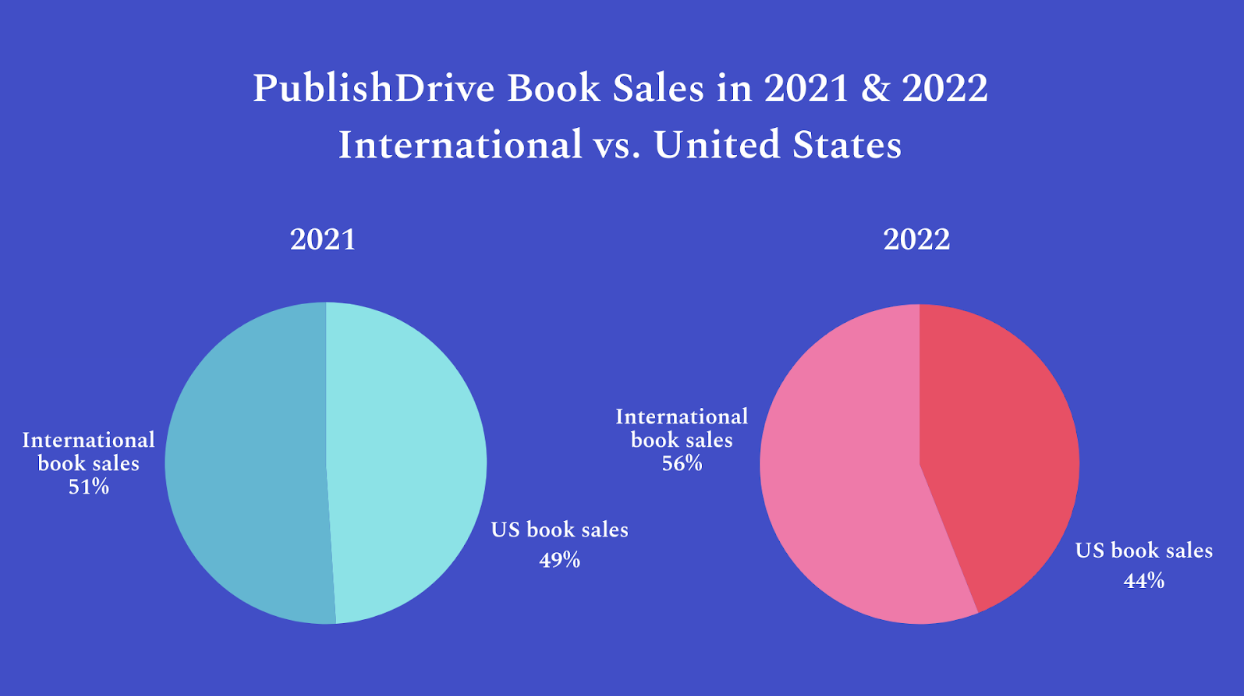

Regarding the distribution of markets, US book sales were at 44% in 2022, which means authors relying solely on the US market should monitor their financial stream strategy and expand to new territories.

4. 2021 Amazon market share

PublishDrive’s book sales doubled in 2021 compared to 2020. (This is amazing because, in 2020, our indies made 85% more sales on average!) More authors and publishers joined the platform. But also, we’ve seen a bump in more uploaded formats like print-on-demand and audiobooks. Plus, more releases overall.

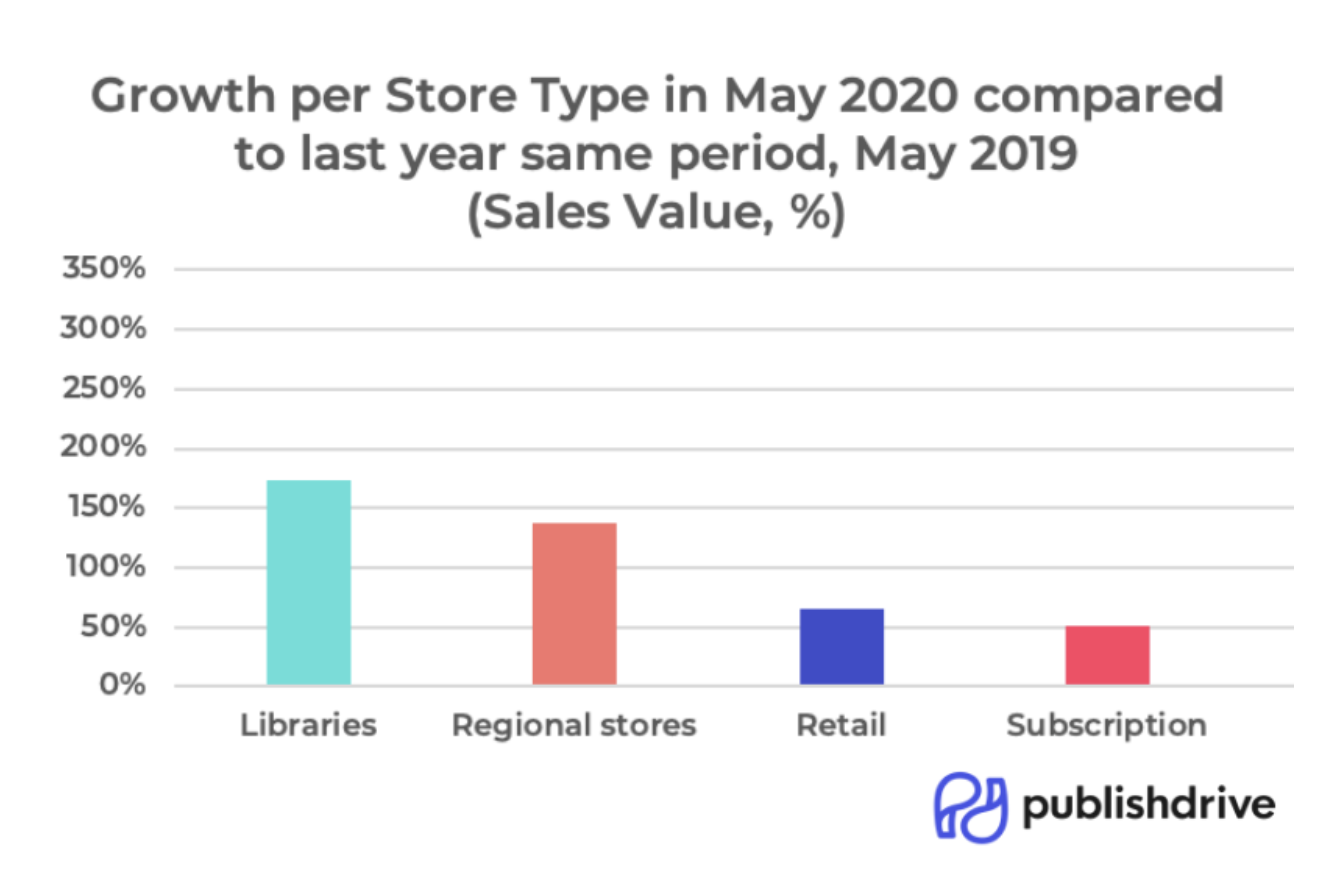

When it comes to revenue sources, retail stores grew by 164%. Subscription stores increased by 27%, determined mainly by audiobook consumption.

Amazon has experienced a growth spike, as you can see in the graphic below. It increased the number of publishers that distributed to Amazon via PublishDrive while keeping their options open.

5. 2020 Amazon ebook market share

In March 2020, PublishDrive saw growth of at least 20% across markets and stores. In April 2020, we reported another 23% growth.

When comparing the mid-year of 2020 with 2019, book sales have increased by 60%. These growing sales numbers benefit PublishDrive indies, who keep 100% royalties. Since we don’t take any commission, publishers get the same royalties as selling directly to stores. All this growth is 100% theirs.

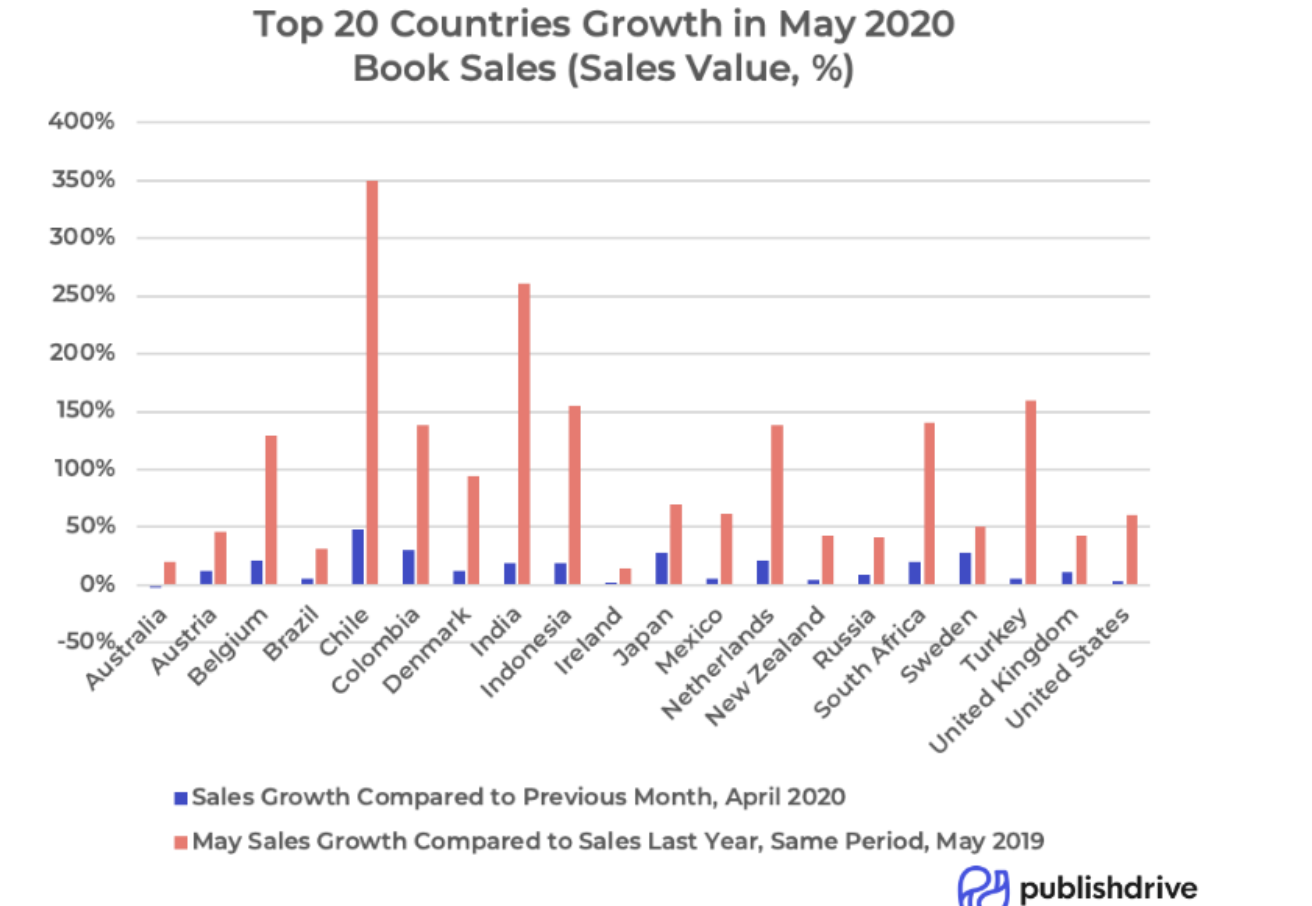

Take a look at the top growth rates by country:

And what the market distribution outlook is based on source of revenue.

6. 2019 Book sales figures on Amazon

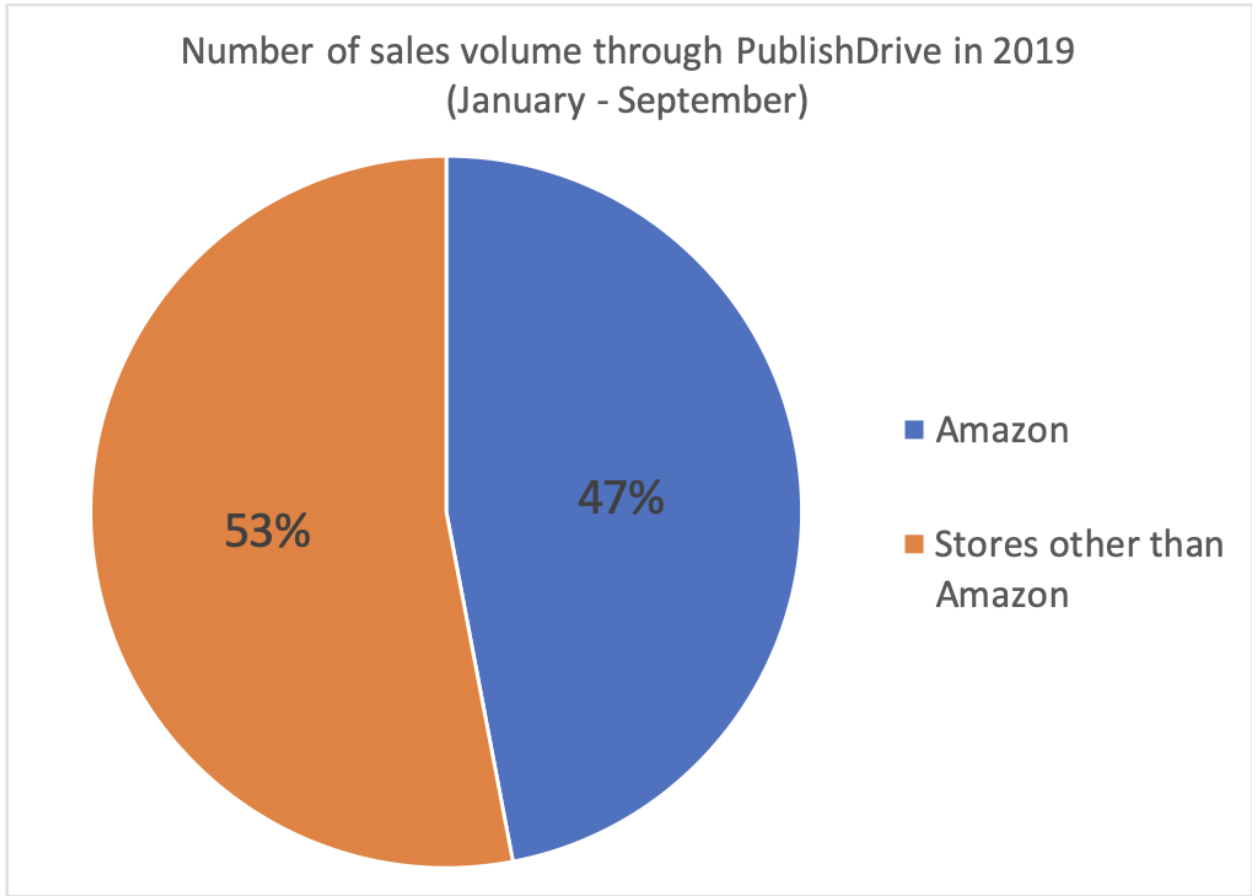

Amazon book sales stats through PublishDrive jumped by 8% in 2019, from 39% in 2018 to 47%.

💡Note that 53% of sales happened in non-Amazon sales channels, a clear reason why Amazon shouldn’t be your only bet.

Every year, more opportunities appear for authors to increase their earnings. In 2019, we introduced the Dreame reading app, which uses a pay-per-episode model.

💫 Kindle Unlimited | KDP Select isn’t the only reading subscription service authors can choose from. Here are the best ebook and audiobook subscriptions you can access via PublishDrive to round your revenue and make the best of wide publishing.

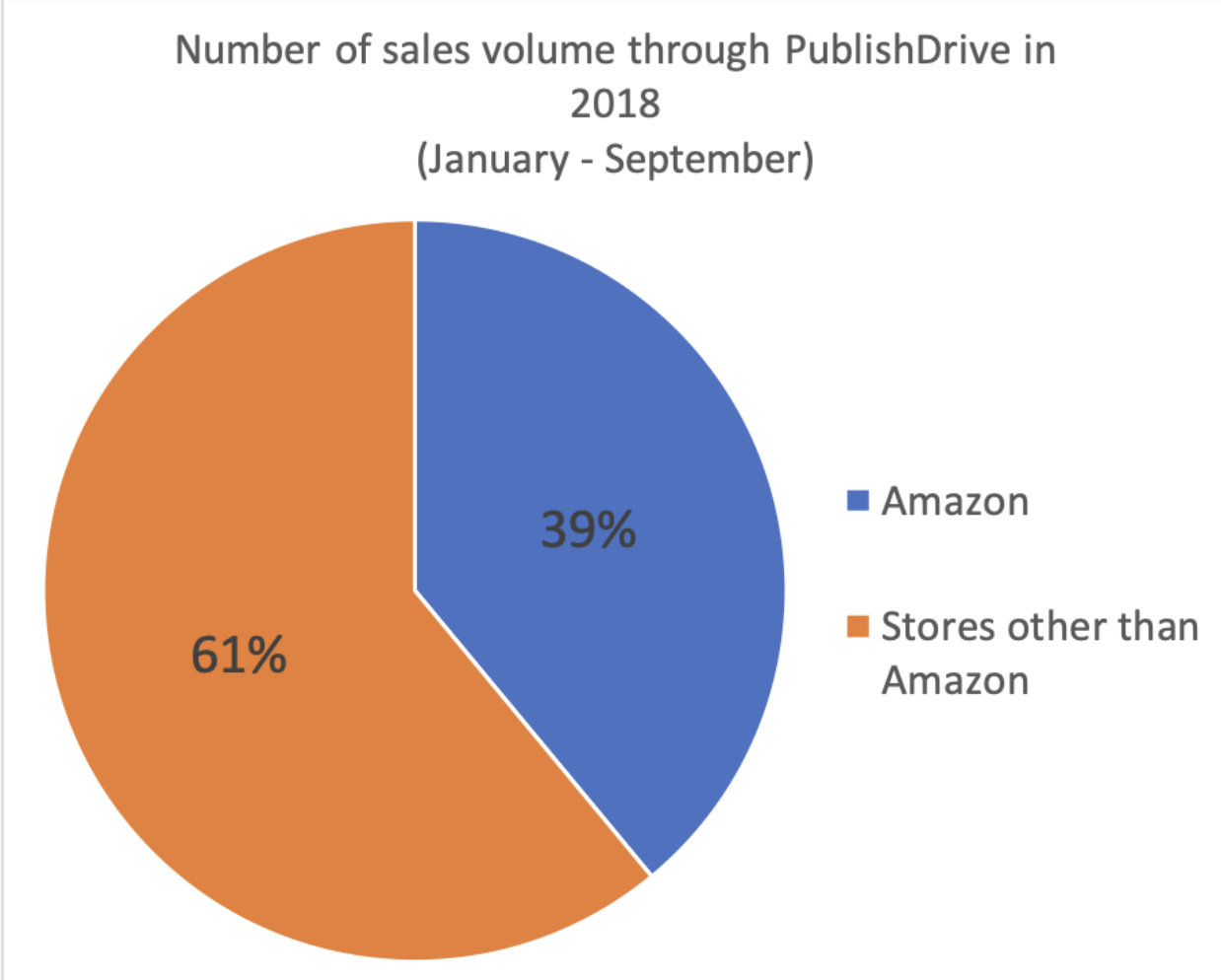

7. 2018 Amazon book sales statistics

In 2018, a large portion of the ebook market included non-Amazon retailers (again!). In 2018, we added DangDang to our distribution network, allowing indie authors to publish in the Chinese market.

Note these numbers include the library book market, not just traditional retail sales.

Library distribution is another non-Amazon market segment that boosts visibility and offers great royalty rates. In 2018, Bibliotheca joined PublishDrive’s growing list of library service providers.

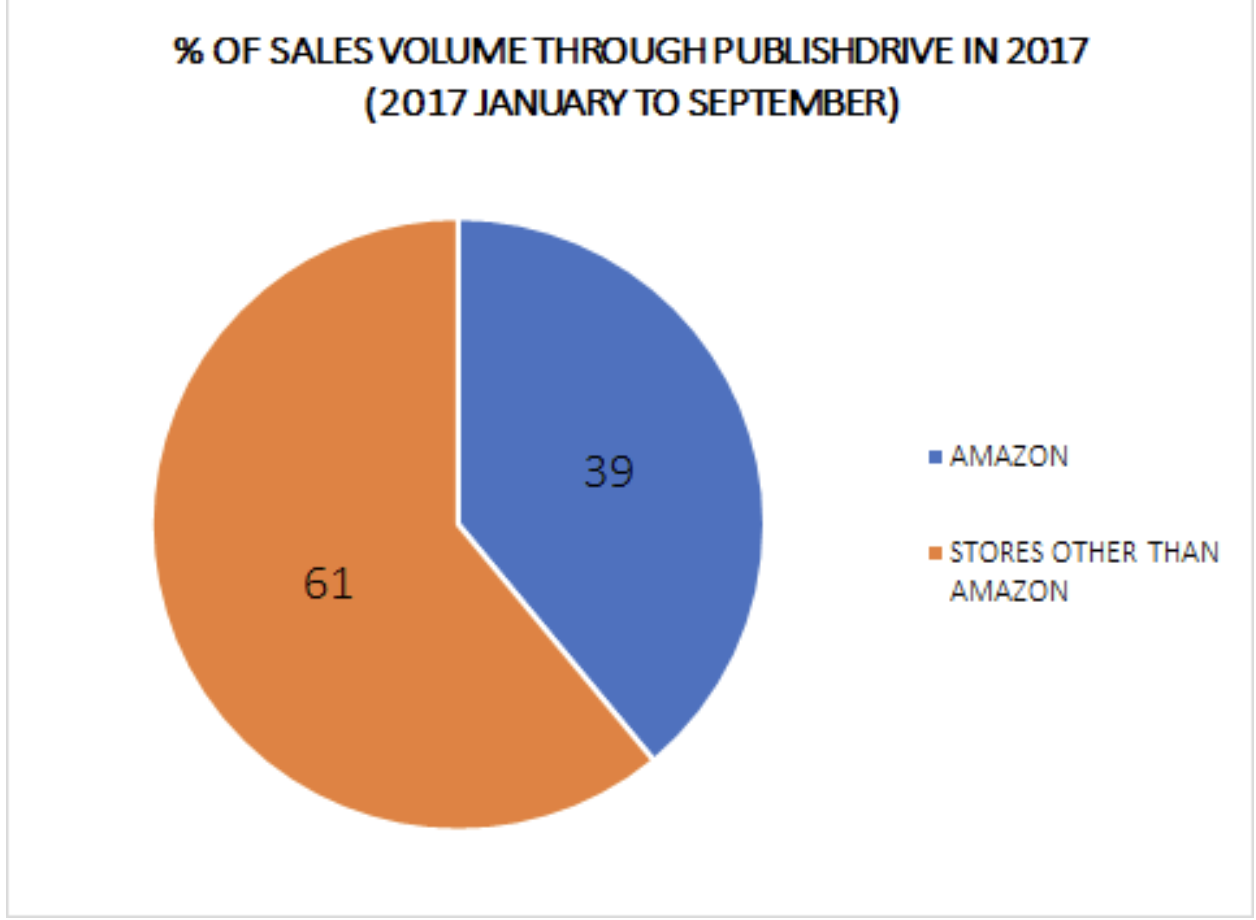

8. 2017 Amazon book sales

Based on the sales numbers of publishers signed up to the platform, in the case of English titles, only 39% of the sales volume came from the Amazon ebook market.

If you sell ebooks on Amazon exclusively through KDP Select, you may lose 61% of your potential readers and sales.

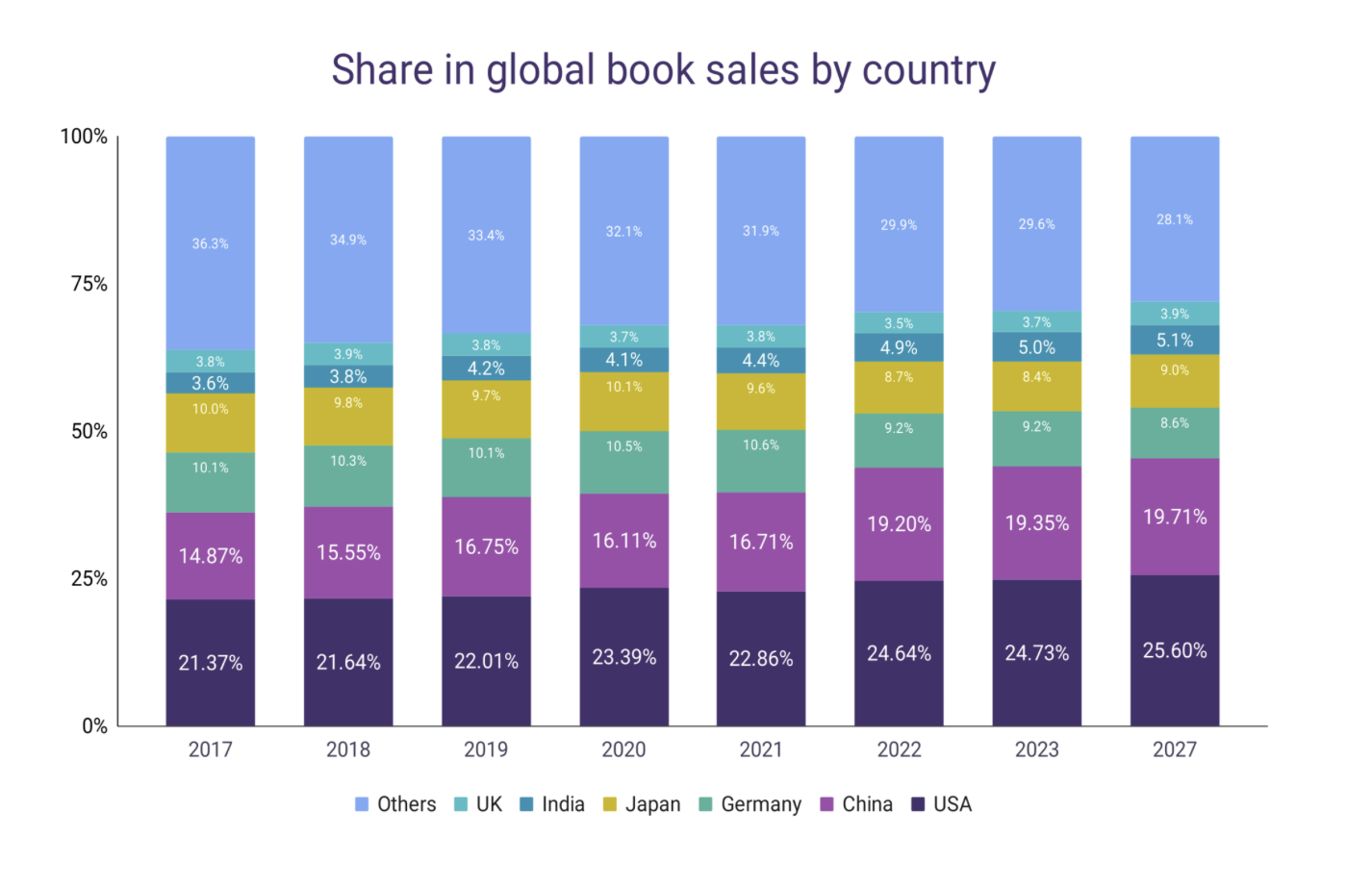

III. Who Is the Global Market?

The global book market is a diverse and complex ecosystem, with readers and consumers from different age groups, geographic locations, and cultural backgrounds.

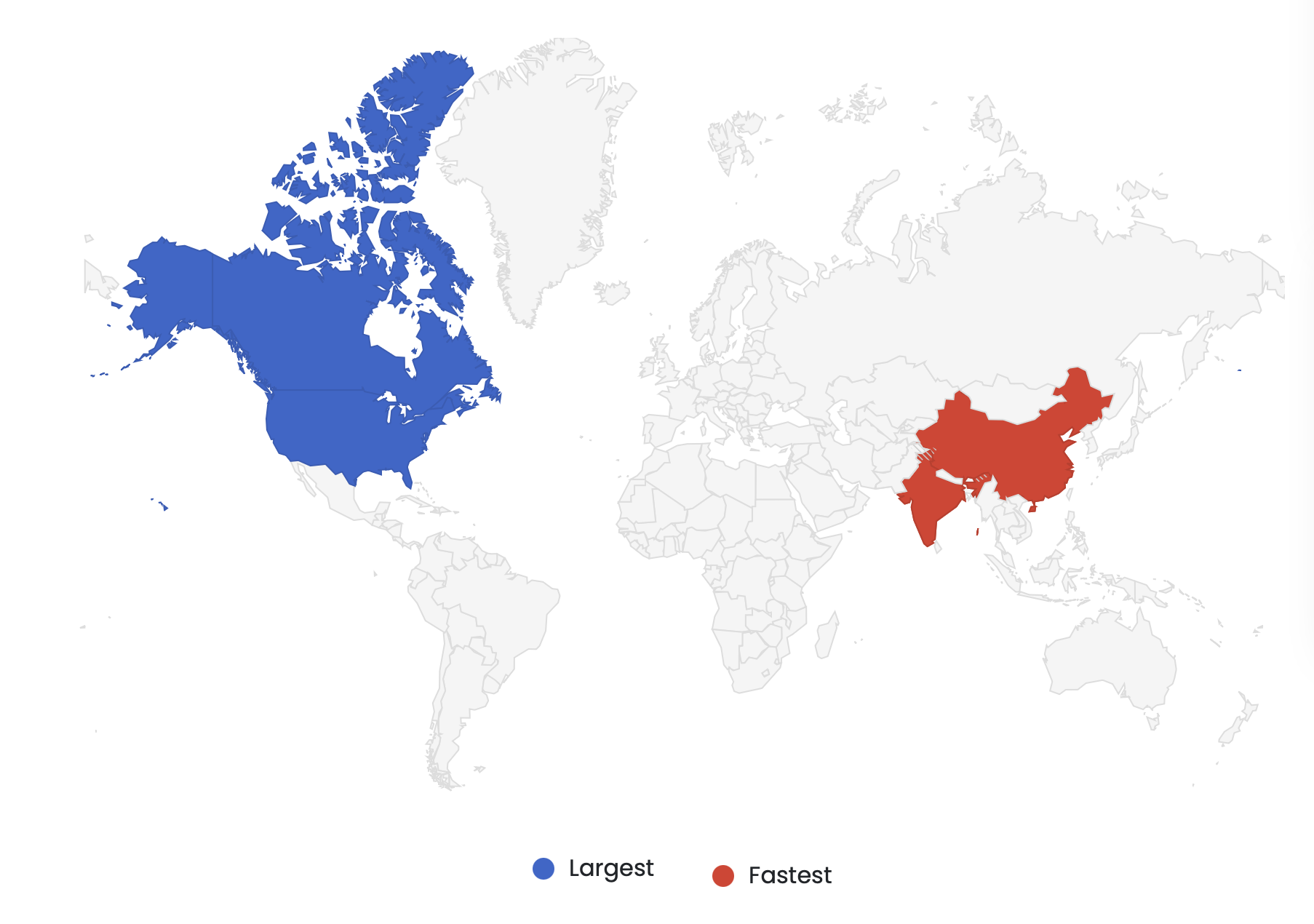

It is dominated by North America, which accounts for 35% of the market, followed by Europe at 25% and the Asia-Pacific region at 20%.

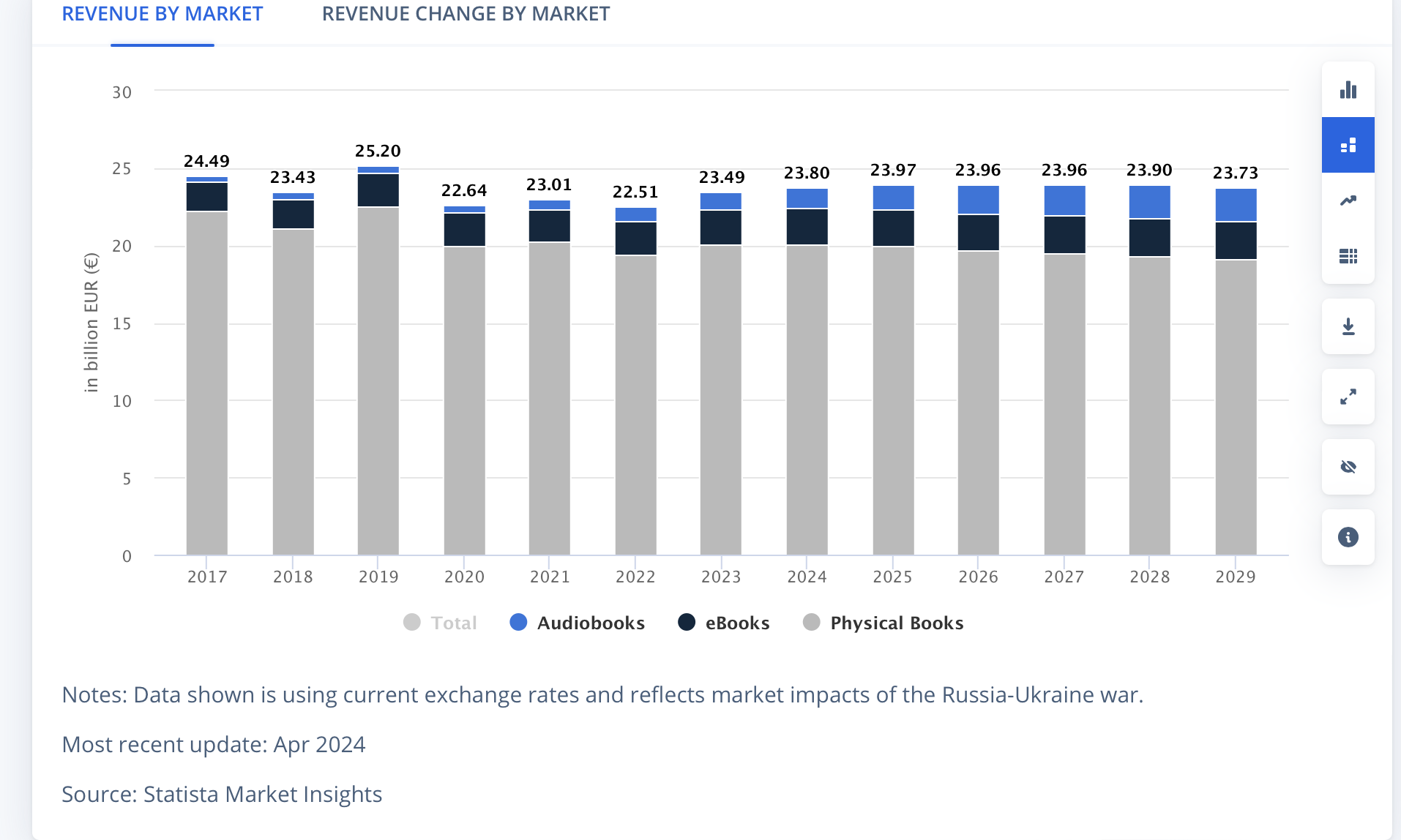

The e-book market size is estimated at $17.20 billion in 2024 and is expected to reach $21.73 billion by 2029, growing at a CAGR of 4.78%.

A. North America

1. United States:

- The US market is expected to remain the largest and most profitable market for English-speaking ebooks and audiobooks. It currently accounts for over 24.7% of all global book sales.

- The country's vast consumer base, diverse demographics, and strong publishing industry will continue to drive growth. Economic stability and an increase in higher education will be contributing factors to readers pursuing their interests and contributing to book market growth.

The presence of a significant group of independent publishers and publishing companies in the region is anticipated to boost the market further.

2. Canada:

- In 2023, the book industry sold 49 million books, with juvenile and young adult subjects leading the market and capturing 40% of the sales. Non-fiction followed with 30%, and fiction with 28%.

B. Europe

- United Kingdom: is the leading European book market. Every UK resident bought an ebook in 2021. The 72 million ebooks sold generated €1.7 billion in revenue.

- Germany: Half of Germany's population purchased an ebook in 2021. The sales amounted to 38 million ebooks, bringing in €505 million.

- Spain sold 20.7 million ebooks, generating €134 million in revenue.

- Netherlands: 1 in 3 people in the Netherlands purchased an ebook in 2021, totaling 6.8 million e-books.

- France sold 19 million ebooks in 2021 and €123 million in revenue.

- Italy: almost 1 in 4 Italians bought an ebook in 2021, with sales reaching 13.2 million items.

Read more on how to:

Reach book distributors in the UK.Make the most of the German market.

Increase your market share in Italy.

Hop on the publishing trends in Spain.

Win the French market.

Navigate book distribution in the Netherlands.

C. Emerging markets

South-eastern Asia book market is booming. Here is why:

- Increasing literacy rates across the region have expanded the potential reader base, creating a larger market for books.

- Technological advancements have facilitated access to publishing and distribution channels through the rise of e-books and online platforms, allowing local and international publishers to reach previously underserved areas.

- Higher disposable incomes increase spending on education and leisure activities such as reading.

But not only in Eastern Asia. Here is how others are doing.

1. India

- Indian ebooks e-commerce market is expected to grow to $528.9 million by 2024, which accounts for 9.8% of the total Books, ebooks, and Audiobooks e-commerce market in India.

- The anticipated annual growth rate (CAGR) from 2024 to 2028 is 13.1%, with an expected market size of $866.4 million by 2028.

- Beginning in 2019, India has become the world’s 5th largest book market, surpassing the UK.

💡 Distribute to India and become part of the growth.

2. China

- The ebook market in China is on a growth trajectory, with projections indicating a revenue of $1.96 billion by 2024. This market is expected to experience an annual growth rate of 5.17% from 2024 to 2027, reaching a market volume of $2.28 billion by 2027.

- The number of eBook readers is anticipated to rise to 0.4 billion users by 2027, with the user penetration rate increasing from 26.8% in 2024 to 28.1% by 2027. The average revenue per user (ARPU) is estimated at $5.00.

- Comparatively, the United States is projected to generate the highest revenue in the eBooks sector, amounting to $5,336.00 million in 2024.

3. Brazil

- Brazil's digital book sales revenue increased by 23% in 2021. This growth was expected to continue at a rate of 1% annually from 2023 to 2028. According to PublishNews, despite predictions, the book market decreased by 7.13%, and revenue fell by 0.78%. This resulted in sales of 54.43 million books, down from 58.61 million in 2022.

- Ebooks represent the majority of digital book copies sold in Brazil.

- More people aged 16-34 are choosing digital books over paper. This change is part of a worldwide shift towards digital media, accelerated by the pandemic.

💡 Distribute to Brazil via PublishDrive.

IV. What Amazon Market Share Means [in fact]

Here is what share of these sales came through Amazon. By relying exclusively on Amazon, authors miss nearly 50% of their potential readers.

Authors should note that in the global book market, local bookshops remain the dominant distribution channel, representing a global revenue share of over 50% in 2023.

The graphic above and the one below should be analyzed together to deliver a complete picture of the impact on the authors’ revenue and why they should not rely exclusively on Amazon.

So the real question is: Why wait to see the Kindle sales reports or browse Kindle statistics when you can reach potential customers globally in just a click with an aggregator like PublishDrive?